- P&L / Trade (total return)

- Largest Loss % (looking for the smallest value)

- P&L / Day

- Win Rate

- Profit Factor

- Sortino Ratio

- Shortest time in trade for winning trades (in terms of % of DTE)

The top scoring iron condor strategy variations for each of these seven categories are listed below. For each metric, the metric value is listed first, followed by the details of the iron condor strategy variation that generated that value, followed by win rates, and finally the strategy score as described in the last article here.

- P&L / Trade (9.1%):

- 80 DTE

- ST structure

- 50 pt. wings

- 20 delta shorts

- 300% stop loss / 75% profit taking

- 2007 - 2016 win rate: 79%

- 2016 - 2017 win rate: 75%

- Strategy score: 67

- Largest Loss % (-11%):

- 66 DTE

- DN structure

- 75 pt. wings

- 8 delta shorts

- 100% stop loss / 50% profit taking

- 2007 - 2016 win rate: 82%

- 2016 - 2017 win rate: 92%

- Strategy score: 72

- P&L / Day (0.18%):

- 45 DTE

- DN structure

- 25 pt. wings

- 20 delta shorts

- 300% stop loss / 50% profit taking

- 2007 - 2016 win rate: 86%

- 2016 - 2017 win rate: 75%

- Strategy score: 74

- Win Rate (96%):

- 80 DTE

- ST structure

- 25 pt. wings

- 8 delta shorts

- 300% stop loss / 50% profit taking

- 2007 - 2016 win rate: 96%

- 2016 - 2017 win rate: 83%

- Strategy score: 90

- Profit Factor (4.5%):

- 80 DTE

- ST structure

- 25 pt. wings

- 8 delta shorts

- 300% stop loss / 50% profit taking

- 2007 - 2016 win rate: 96%

- 2016 - 2017 win rate: 83%

- Strategy score: 90

- Sortino Ratio (0.25):

- 80 DTE

- DN structure

- 50 pt. wings

- 8 delta shorts

- 100% stop loss / 75% profit taking

- 2007 - 2016 win rate: 77%

- 2016 - 2017 win rate: 75%

- Strategy score: 69

- %DTE (30%):

- 80 DTE

- EL structure

- 25 pt. wings

- 8 delta shorts

- 100% stop loss / 50% profit taking

- 2007 - 2016 win rate: 79%

- 2016 - 2017 win rate: 67%

- Strategy score: 74

Out of these seven iron condor strategy variations, there was one duplicate...the strategy that generated the top win rate was also the strategy that generated the top profit factor. Now, lets look at the equity curves for these six strategy variations. Note, for reference, an SPX chart is included below the equity curve chart.

|

| (click to enlarge) |

|

| (click to enlarge) |

The two iron condor strategy variations using 20 delta short strikes had the highest returns, but also the least smooth equity curves. The strategy variation with the highest win rate, had the third highest returns on this chart, but has been under performing in 2017.

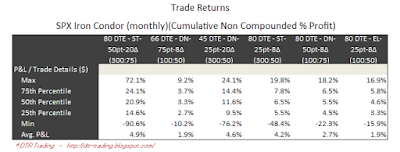

The return distribution for these monthly trades for the initial test range (January 2007 through September 2016) is shown in the table below.

|

| (click to enlarge) |

The strategy variation with the shortest time in trade, also had the smallest absolute loss, but not the smallest loss as a percentage of capital at risk. This table doesn't provide any new information, but does provide some data driving the shapes of the equity curves shown above.

Now let's take a look at the returns for the one year period running from July 2016 expiration through the June 2017 expiration.

|

| (click to enlarge) |

During this recent one year period, the win rates and returns for these iron condor strategy variations (except for one!) have lagged their historical averages.

The one strategy variation that bucked this under performance trend was the one with the smallest "Largest Loss" number...the 66 DTE, DN structure, 75 pt. wing, 8 delta short iron condor with a 100% stop loss and a 50% profit taking level. This strategy had a 25.2% return during this most recent one year test period, with a win rate of 92%. Historically, this strategy returned 18% per year, with a win rate of 82%. Note, this is the strategy with the solid red equity curve above.

The other strategy variation that was closest to it's historical metrics was the one with the highest Sortino Ratio...the 80 DTE, DN structure, 50 pt. wing, 8 delta short iron condor with a 100% stop loss and a 75% profit taking level. This strategy had a 20.1% return during this most recent one year test period, with a win rate of 75%. Historically, this strategy returned 32% per year, with a win rate of 77%. Note, this is the strategy with the red dashed equity curve above.

The two better preforming strategy variations during this recent one year period were both delta neutral (DN) structures.

In the next article, we'll look at a few of the higher scoring iron condors. These tended to be initiated at 80 DTE, with short strike deltas at either 8 or 12.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

4 comments:

Great work as always! Thank you for sharing this info! Especially the recent year performance as the slow grind upward seems to be a uniquely challenging period for many IC strats that have worked well in the past. Greatly appreciate your contribution!

Thank you for your feedback!

Dave

David,

Great study.. Very helpful

I was wondering that is it possible to add buy and hold equity curve into compounded non cumulative % profit chart?

That's a good idea, and I've done that in the past. I'll look at adding that to future posts.

Thanks,

Dave

Post a Comment