These are the IC variations we will review:

- 66 DTE - 25 pt wings, 12 Delta (200:50) / 2 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 2 DTE.

- 66 DTE - 25 pt wings, 12 Delta (200:50) / 33 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 33 DTE.

- 73 DTE - 25 pt wings, 12 Delta (200:50) / 2 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 2 DTE.

- 73 DTE - 25 pt wings, 12 Delta (200:50) / 37 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 37 DTE.

- 45 DTE - 25 pt wings, 16 Delta (200:50) / 2 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 2 DTE.

- 45 DTE - 25 pt wings, 16 Delta (200:50) / 22 DTE - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at 22 DTE.

The 45 DTE variations follow the entry and exit criteria popularized by TastyTrade here:

- https://www.tastytrade.com/tt/shows/market-measures/episodes/managing-losers-in-risk-defined-strategies-10-24-2016

- https://www.tastytrade.com/tt/shows/from-theory-to-practice/episodes/portfolio-tactics-managing-iron-condors-early-02-06-2019

- https://www.tastytrade.com/tt/shows/market-measures/episodes/iron-condors-trade-size-08-16-2017

- https://www.tastytrade.com/tt/shows/market-measures/episodes/exiting-iron-condors-01-02-2015

For each IC variation, I show one table and two charts. The table shows the percent return on reg-t margin. The first chart shows these same return numbers, but compared to their historical returns (max, min, average, and quartiles).The second chart shows the DIT numbers for each variation compared to the average for this variation.

Let's get right to the results for each of these variations.

66 DTE - 25 pt wings, 12 Delta (200:50) / 2 DTE

The average monthly return for Q1 was -7%, versus the 2007 to 2018 monthly average of +3%. Total return for the quarter was -21%. Pretty bad return numbers. The average DIT for Q1 was 34, which was above the 2007 to 2018 average of 30 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

66 DTE - 25 pt wings, 12 Delta (200:50) / 33 DTE

The average monthly return for Q1 was +5%, versus the 2007 to 2018 monthly average of +4%. Total return for the quarter was +15%. One of the few trades/variations (ICs, Straddles, Strangles) this quarter with positive quarterly return numbers. The average DIT for Q1 was 29, which was above the 2007 to 2018 average of 25 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

73 DTE - 25 pt wings, 12 Delta (200:50) / 2 DTE

The average monthly return for Q1 was -10%, versus the 2007 to 2018 monthly average of +2%. Total return for the quarter was -29%. Pretty bad return numbers. The average DIT for Q1 was 36, which was above the 2007 to 2018 average of 33 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

73 DTE - 25 pt wings, 12 Delta (200:50) / 37 DTE

The average monthly return for Q1 was -3%, versus the 2007 to 2018 monthly average of +1%. Total return for the quarter was -9%. Not great return numbers, but still tradeable. The average DIT for Q1 was 33, which was above the 2007 to 2018 average of 28 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

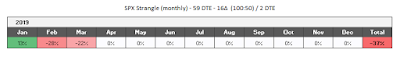

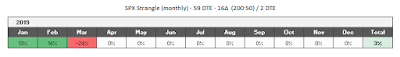

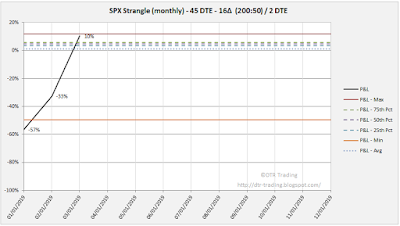

45 DTE - 25 pt wings, 16 Delta (200:50) / 2 DTE

The average monthly return for Q1 was -34%, versus the 2007 to 2018 monthly average of +3%. Total return for the quarter was -101%! Horrible return numbers for this IC variation! The average DIT for Q1 was 37, which was above the 2007 to 2018 average of 24 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

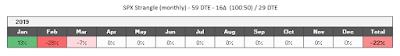

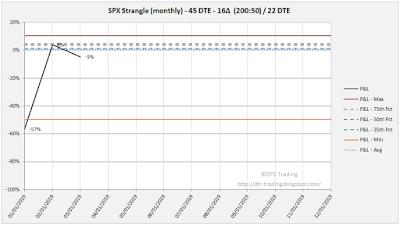

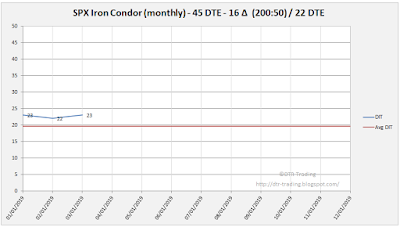

45 DTE - 25 pt wings, 16 Delta (200:50) / 22 DTE

The average monthly return for Q1 was -18%, versus the 2007 to 2018 monthly average of +2%. Total return for the quarter was -53%. Pretty lousy returns for Q1. The average DIT for Q1 was 23, which was above the 2007 to 2018 average of 20 DIT.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

The 45 DTE variations were clearly the worst for the quarter. The 66 and 73 DTE variations that managed early were decent performers.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.