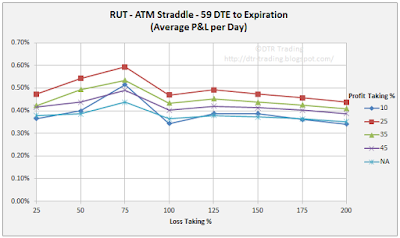

In this post, I am going to show the P&L results in line-chart form rather than the heat map tables I used in the last articles. The data in the charts below is only for the non-IVR filtered trades. The first set of charts shows the P&L Per Day amounts, with each chart representing the results for trades started at the same days to expiration (DTE). Here are a few key points for each chart:

- Each colored line in a chart represents a particular profit taking percentage level in terms of the credit received

- The X-axis displays the loss taking percentage level in terms of the credit received

- The Y-axis displays the average normalized percent P&L per day

- The Y-axis scale is the same for all the P&L per day charts in this article

Before we go further, I want to reiterate that these returns are the average normalized returns per day. What does this mean? Here are a few points to consider, and that I considered, when calculating these P&L numbers:

- Each data point in each of the seven P&L per day charts had different average trade durations. One data point may have had an average of 15 DIT, while another may have had an average of 60 DIT. With most of these strategy variations, there were approximately 100 trades entered for each data point in the charts below. 100 times 15 is 1500 total DIT for a strategy, while 100 times 60 yields a total of 6000 DIT. The number of DIT obviously impacts the average P&L per day.

- When a straddle is entered at 38 DTE its initial portfolio margin (PM) requirement is going to be greater than say a straddle entered at 80 DTE. The difference in margin requirement can be nearly 20% greater in this example. This initial PM number must be taken into account in order to fairly compare P&L per day values...and has been in the charts below. Using dollar amounts instead of average normalized P&L per day would not necessarily take into account the different margin requirements for the different DTE variations.

With that background information finished, let's dive into the charts...

38 DTE

|

| (click to enlarge) |

45 DTE

|

| (click to enlarge) |

52 DTE

|

| (click to enlarge) |

59 DTE

|

| (click to enlarge) |

66 DTE

|

| (click to enlarge) |

73 DTE

|

| (click to enlarge) |

80 DTE

|

| (click to enlarge) |

----

The next set of charts contains the average normalized P&L per trade for the seven different DTE reviewed in my RUT straddle backtest series. The different initial PM requirements were used when calculating the P&L per trade numbers similar to how the PM was used in calculating the P&L per day numbers. Also, as above, the next seven charts use the same Y-axis scale...now to the charts.

38 DTE

|

| (click to enlarge) |

45 DTE

|

| (click to enlarge) |

52 DTE

|

| (click to enlarge) |

59 DTE

|

| (click to enlarge) |

66 DTE

|

| (click to enlarge) |

73 DTE

|

| (click to enlarge) |

80 DTE

|

| (click to enlarge) |

For most of the charts, the 10 percent profit taking level and the 25% loss almost always yielded a return of 5% on the PM requirement...and the PM requirement becomes smaller as we move out in DTE. So, 5% at 38 DTE is going to be a greater dollar amount than 5% at 80 DTE. I thought the data around the 10% profit taking level was interesting.

When we are actually trading these straddles, not just analyzing the data, we need to consider effective capital utilization. Let's look at a quick example:

- Profit taking at the 10 % level will generally have your DIT at about 30% of DTE. So, for a 38 DTE trade we can expect to be in the trade for approximately 11 days, while an 80 DTE trade would last approximately 24 days to hit the same 10% profit taking level.

- For the 10% profit taking level, using a 25% loss target, will yield approximately a 5% return on PM at both 38 DTE and 80 DTE...but the 5% number will be a larger dollar value at 38 DTE than at 80 DTE.

- This is a slightly contrived example, but it illustrates how to consider applying the data in my blog posts to your trading.

When we consider profit taking targets we need to consider how these targets impact DIT. Here are a few approximations that seem to hold with RUT straddles:

- The 10% profit taking level will have your DIT at approximately 30% of DTE

- The 25% profit taking level will have your DIT at approximately 60% of DTE

- The 35% profit taking level will have your DIT at approximately 70% of DTE

- The 45% profit taking level will have your DIT at approximately 80% of DTE

Don't forget, that as the profit taking level is increased, the win rate drops. See my RUT Straddle Summary Page for links to all of the articles in the series. Lastly, over the next several days I will tweet (@DTRTrading) win rate line-charts and DIT line-charts, similar to those above.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment