For background on the setup for the automated backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Straddle Series - P&L Exits.

In the trade metrics tables, some of the metrics rows have been highlighted to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (P&L % / Trade - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement. Also note that the y-axis scale is the same in all of the 80 DTE equity curves.

No IV Rank Filter

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility rank (IVR) of the SPX on the date of entry. Entering these trades at 80 DTE and utilizing our loss exits (described here) resulted in the equity curves below. These equity curves do not look as good as the prior 73 DTE curves.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. The win rates are not great, with the best numbers coming in at 62%. The win rates are similar to the corresponding 66 DTE variations. The total P&L % numbers are also not as good as the corresponding 66 DTE and 73 DTE variations. As a reminder, these trades are either exited at expiration OR at the designated loss level.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

Below are two images of scatter plots for selling 80 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IVR for the SPX. The IVR was captured on the day each trade was initiated. The profitable trades follow a trajectory that curves up slightly as IVR increases. Also, since no profit target was used, the returns are fairly evenly distributed across IVR levels.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated. We see the familiar cluster of trades in the region between 10 and 30 IV.

|

| (click to enlarge) |

Even without profit management or an IVR filter, approximately 60% of the trades were profitable at a loss management level of 75% or greater. The trend of increasing IV yielding higher returns is barely perceptible in these scatter plots.

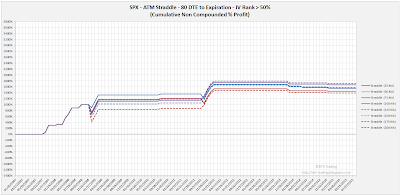

IV Rank > 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is greater than 50% ( >50% ). Entering these trades at 80 DTE and utilizing our loss exits (described here) resulted in the equity curves below. As we've seen in my prior posts, the curves have long periods that are flat...these are times when no trades were taken due to the IVR being below the filter level. This is a familiar pattern that we have seen with all of the trades using the IVR > 50% filter.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. These trades have better win rates, significantly better returns per day, and better returns per trade than the non-IVR filtered trades. These latter two metrics were about three times higher. The total P&L% for these filtered trades was a bit more than half the total P&L% for the non-IVR filtered. Also note, that only a little less than 20% of the total trades satisfied the IVR filter of > 50%.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

IV Rank < 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is less than 50% ( <50% ). Entering these trades at 80 DTE and utilizing our loss exits (described here) resulted in the equity curves below. 2015 continues to have a huge positive impact on these trade variations.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. These trades have lower win rates and lower total P&L per day and P&L per trade numbers than the non-IVR and IVR > 50% filtered trades shown above.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

The 80 DTE SPX short straddles without profit management did not perform as well as some of the other DTE variations. We now have our baseline for the 80 DTE strategies, so we can move on to the profit taking versions.

In the next post we will look at the automated backtest results of 80 DTE SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 10% of the credit received.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment