For background information associated with the results in this post, please see the following posts:

- Option Straddle Series - P&L Exits

- SPX Straddle - 45 DTE - No Profit Management

- SPX Straddle - 45 DTE - Manage Profits at 10% of the Credit Received

- SPX Straddle - 45 DTE - Manage Profits at 25% of the Credit Received

- SPX Straddle - 45 DTE - Manage Profits at 35% of the Credit Received

- SPX Straddle - 45 DTE - Manage Profits at 45% of the Credit Received

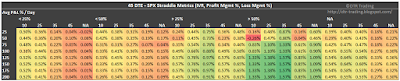

The results in this post are summarized in six heat map tables. In these tables, each row corresponds to a different loss exit percentage. For example, the first row (25) corresponds to the strategy variations where losses were taken at 25% of the credit received. These rows have values from 25 to 200. The columns are a little more complicated, and are grouped first by implied volatility rank (IVR) level, and then by profit exit percentage. You can see that each IVR percentage level contains five columns (10, 25, 35, 45, and NA)...with each column representing a profit taking percentage. For example, the first column lists all of the strategy variations where the IVR was less than 25% and profits were taken at 10% of the credit received.

The first table shows the average normalized P&L per day by IVR, profit taking percentage, and loss taking percentage. The highest daily returns are concentrated in the IVR > 50% columns, specifically the columns associated with profit taking at 25% and 35%. The other area of strength was the IVR > 25% and profit taking at 35%.

|

| (click to enlarge) |

The second table shows the average P&L per trade by IVR, profit taking percentage, and loss taking percentage. The area with the highest P&L per trade values was IVR > 50% and profit taking at 25%, 35%, and no profit management (NA). Another area of strength was the IVR >25% and profit taking at 35%.

|

| (click to enlarge) |

The third table shows the win percent / win rate by IVR, profit taking percentage, and loss taking percentage. The highest win rates occur at lower profit taking levels...the lower the profit taking percentage, the higher the win rate for a given IVR grouping. This highest individual win rates occur with an IVR > 50% and profit taking at 10%. The most consistently high win rates are associated with an IVR < 25%, and profit taking at 10%. At this level, six of the eight variations have win rates of 92%.

|

| (click to enlarge) |

In the fourth table, we see the Sortino Ratio by IVR, profit taking percentage, and loss taking percentage. The highest Sortino Ratios were associated with an IVR > 50%, profit taking at 10%, 25%, and 35%, and high loss taking percentages (125% through 200%).

|

| (click to enlarge) |

The fifth table shows the profit factor by IVR, profit taking percentage, and loss taking percentage. The largest profit factor values occurred in the same area containing high Sortino values. This highest Sortinos were associated with an IVR > 50%, profit taking at 10%, 25%, and 35%, and high loss taking percentages (125% through 200%).

|

| (click to enlarge) |

The last table shows the average days-in-trade (DIT) by IVR, profit taking percentage, and loss taking percentage. What does this show...the quicker the profit taking, the shorter the time spent in a trade...obvious results here. Limiting your losses to 25% of the credit received also took you out of the trades sooner.

|

| (click to enlarge) |

Which variation of the 45 DTE straddles is best? As I've mentioned before, that depends on your risk tolerance. If I was going to trade a 45 DTE ATM SPX straddle, I would gravitate towards the variation highlighted by Tastytrade...taking profits at 25% and taking losses at 125%. Based on the data, I'm not sure I would apply the IVR > 50% filter though...causes you to miss out on too many profitable trades. You can find links to all of my SPX straddle articles on the SPX Straddle Summary Page.

In the next post, we will start looking at the automated backtest results for the short straddle on the SPX at 52 DTE.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

7 comments:

Incredible stuff. Keep up the good work!

Thanks Brad...I appreciate the feedback!

This is awesome information. I was wondering, have you considered backtesting short options strategies like straddles, strangles, on futures options? I was checking out the Buying Power Reduction and credit for these on TOS, and the ratio of Credit received for the straddle/strangle to the Buying Power Reduction seems to be really strong. If shorting the options on futures is profitable, could be a good way to diversify, and get more opportunities to go short.

Hi Yoshi,

Thank you for the kind words. You bring up two points in your question.

The first is related to data...I have not found a source for futures options data, so I have not been able to test strategies on options on the futures products...I would like to though! Specifically /CL, /6E, and /ZB.

Your second question is related to margin/buying power reduction. For the strangles and straddles that I tested, I used my PM requirements (pre Sep 1 TD margin changes). The margin requirements that I used for these undefined risk trades should be very close to the margin required for futures options on those products (/ES & /TF).

If you don't have a PM account, then tradings options on /ES & /TF should lead to similar results as my strangle tests on the SPX and RUT, and my current straddle tests on the SPX.

Hope this helps.

Dave

So, searching around, I may have found some sources for futures option data. Here is the first source that I found.. "

If you're a non-professional (as in the NYSE/NFA definition), I highly recomment getting the MetaStock Xenith platform. Don't let the name fool you. This product is in fact a full fledged Reuters Eikon, which sells for around 2k per month. They just changed the logo to MetaStock, set the price to around 100 bucks a month and started selling to 'non-professionals'.

And before I get the question: I have no financial incentives whatsoever for recommending this product. I did work for them once, but that was a long time ago.

and the second

"Check out www.quantgo.com which has 6+years of futures data including the options data but you have to use a virtual computer in their cloud. QuantGo focuses on people wanting institutional tick data without having to pay $10,000++ to buy it...they rent you the access for approx $250 per month."

Yoshi,

Thanks researching futures options data and for sharing this info.

My backtesting framework and strategies are custom, so it would be really time consuming (if even possible) to build the application in another platform.

Were you able to find any "pure" data providers, that allow the purchase and download of futures options data? For non-futures options data (indices, ETFs, etc), I've used:

iVolatility: http://www.ivolatility.com/

Historical Options Data: https://www.historicaloptiondata.com/\

LiveVol: http://www.livevol.com/

Thanks again!

Dave

I am checking with iVolatility...looks like they just started offering futures options data.

Post a Comment