- STD - NA%:NA% - exit at 8 DTE.

- STD - NA%:50% - exit if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 100%:50% - exit if the trade has a loss of 100% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 200%:50% - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 200%:75% - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 75% of its initial credit OR 8 DTE.

- STD - 300%:50% - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 300%:75% - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 75% of its initial credit OR 8 DTE.

- STD - 400%:50% - exit if the trade has a loss of 400% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

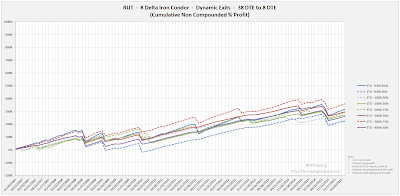

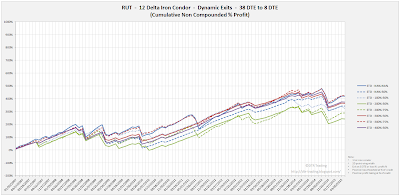

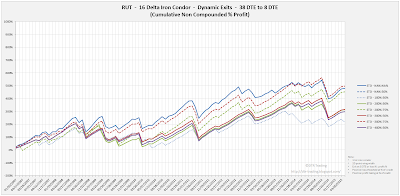

We applied these exits to iron condors with different delta short strikes (8, 12, 16, and 20 delta) at different days to expiration (38, 45, 52, 59, 66, and 80). Please see the following links for the background information associated with the results in this post:

- Iron Condor Series - Higher Loss Thresholds

- RUT Iron Condor - High Loss Threshold - 38 DTE

- RUT Iron Condor - High Loss Threshold - 45 DTE

- RUT Iron Condor - High Loss Threshold - 52 DTE

- RUT Iron Condor - High Loss Threshold - 59 DTE

- RUT Iron Condor - High Loss Threshold - 66 DTE

- RUT Iron Condor - High Loss Threshold - 80 DTE

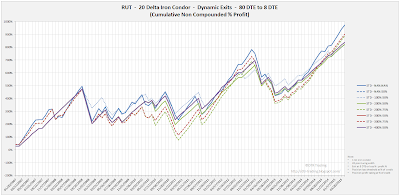

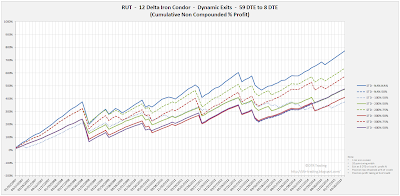

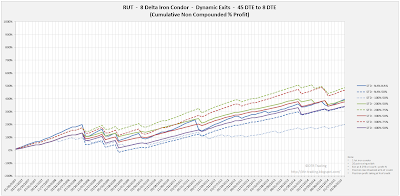

Let's review the equity curves for four of the combinations listed above, to get a qualitative sense of the performance. Recall that the y-axis scale is the same for all of the equity curves (-200% to 1000%), except for the 16 and 20 delta variations of the 66 DTE trade (-200% to 1400%). The thumbnails are small, but larger images will be displayed if you click on them.

|

| (click to enlarge) |

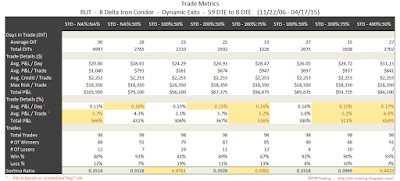

With these equity curves as a qualitative reference, let's look at the associated trade metrics. The four tables below show the top 20 strategy variations (out of 192) in terms of selected metrics.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

Deciding on a specific RUT iron condor exit strategy depends on your goals:

- Want a high Sortino Ratio - go with an 59 to 66 DTE, 8 delta short strikes, managing the profits at 75%, and managing the loss at 200%. Historically, this approach has averaged more than 5% per trade with a win rate at 87%.

- Want a win rate - go with an 45 to 66 DTE, 8 delta short strikes, managing the profit at 50% and the loss at 400%. Historically, this approach has averaged around 4% per trade with a win rate of 93%.

- Want the highest returns / return per trade - go with a 66 DTE, 16 or 20 delta short strikes, managing the profit at 75%, but the loss at either 200% or 300%. Historically, this approach has averaged over 11% per trade with a win rate of between 78% and 85%.

- Want the highest returns per day - go with a 45 DTE, 16 delta short strikes. managing the profit at 50% and the loss anywhere from 200% to 400%. Historically, this approach has averaged over 6% per trade with a win rate of 83%.

NOTE: Since the original posting, I have updated the tables above to exclude the metrics that were shown in dollar ($) terms. See the comments section for the explanation.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.