- Correlation between Iron Condor strategy structure / management and result metrics

- Which result metrics most influence equity curve shape

- Correlation between result metrics

- Correlation between initial trade conditions and trade outcome based on strategy variation

In the last article we looked at items 1 and 2, and in this article we will look at items 3 and 4. We will start with the correlation between result metrics. For reviewing the correlation numbers, I'll use the following guidelines:

- -0.5 to -1.0 or +0.5 to +1.0: strong correlation

- -0.3 to -0.5 or +0.3 to + 0.5: moderate correlation

- -0.1 to -0.3 or +0.1 to +0.3: weak correlation

- -0.1 to +0.1: no correlation

While there is not 100% agreement on these levels across experts, these levels are fairly close to the common ranges listed in a number of statistics articles and books.

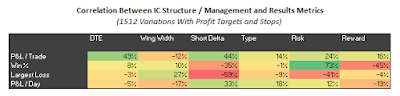

3. Correlation Between Result Metrics

The correlation matrices below show the results for all 3024 strategy variations, and also the subset of 1512 strategy variations that just contain profit targets and stops. There isn't any surprising information in these two matrices. The strong correlations in the tables are exactly where you would expect strong correlations to exist.

|

| (click to enlarge) |

|

| (click to enlarge) |

4. Correlation Between Initial Trade Conditions and Returns

This is the most interesting topic. I've analyzed if there is any relationship between the conditions at trade entry and the P&L for a trade. For initial conditions, I used the following indicator values from the day a trade was initiated:

- IV Correlation: average implied volatility (IV) of the at the money (ATM) call and put

- VIX Correlation: VIX

- Skew 10: skew calculation based on 10 delta and 50 delta calls and puts (see note below)

- Skew 25: skew calculation based on 25 delta and 50 delta calls and puts (see note below)

- Skew 40: skew calculation based on 40 delta and 50 delta calls and puts (see note below)

- Put Slope: indicator based on IV of 10 puts at various deltas (8, 12, 16, 20, 25, 30, ... , 50)

- Slope(50-12): indicator based on slope of IVs at 12 delta and 50 delta

- Slope(50-30): indicator based on slope of IVs at 30 delta and 50 delta

- Credit: credit received per trade

- Above/Below MA(50): whether the SPX is above/below it's MA(50) (-1, 0, +1)

- Above/Below MA(200): whether the SPX is above/below it's MA(200) (-1, 0, +1)

- ATR-50: indicator based on the number of ATRs the SPX is above/below it's MA(50)

- ATR-200: indicator based on the number of ATRs the SPX is above/below it's MA(200)

Note: skew calculation based on Mixon paper: What Does Implied Volatility Skew Measure?

The 25th percentile, mean, and 75th percentile values for each of these indicators at 80 DTE is displayed in the table below. This will give you an idea of the distribution of the indicator values between January, 2007 and September, 2016.

|

| (click to enlarge) |

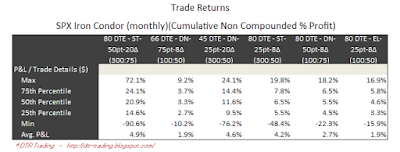

The correlation between returns and these indicators is shown in correlation tables below. Each table is for a specific DTE, short strike delta, wing width, stop loss, and profit target. Each table also includes the three Iron Condor starting structures (DN - delta neutral, EL - extra long put, and ST - standard balanced). Each row corresponds to a particular wing width, and each column corresponds to a particular stop loss level. My biggest take away was that there was either weak correlation or no correlation between indicator values at trade initiation and the final trade results.

The nine correlation tables below are for the 80 DTE Iron Condor variations with 8 delta short strikes. Across these tables, there were only 11 values of 0.2 / 20% or greater. 7 of these values occurred with the DN structure. 4 of these 11 values were associated with the VIX. Overall, though, any correlation of returns with initial conditions was weak for these trade variations.

|

| (click to enlarge) |

The nine correlation tables below are for the 80 DTE Iron Condor variations with 12 delta short strikes. Across these tables, there were only 41 values of 0.2 / 20% or greater. A much larger number than for the variations with 8 delta short strikes. 17 of these values occurred with the EL structure, 15 with the ST structure. 14 of these 41 values were associated with the Slope(50-12) indicator, and 10 with the Credit. Again, overall, any correlation of returns with initial conditions was weak for these trade variations.

|

| (click to enlarge) |

For the sake of completeness, the indicator values and correlations at 66 DTE are included below. There are six correlation tables for the 66 DTE Iron Condor variations with 12 delta short strikes. Across these tables, there were only 21 values of 0.2 / 20% or greater. 9 of these values occurred with the ST structure. 10 of these 21 values were associated with the Skew 40 indicator, and 6 with the ATR-50 indicator. Incidentally, the Skew 40 indicator also had one correlation value that hit 0.3. Regardless, any correlation of returns with initial conditions was also weak for these trade variations.

| (click to enlarge) |

|

| (click to enlarge) |

I think the big take away from this correlation analysis is that the market conditions at trade initiation, specifically indicator readings, have almost no ability to predict the final returns for these Iron Condors. So, don't overthink your entries.

I'm still reflecting on a quote from Euan Sinclair on the Talton Capital Management blog and how it relates to these results:

"always use the simplest method possible. Trading is a business. Problems are to be solved, not treated as sources of amusement or intellectual challenges. Brute force is often a perfectly acceptable technique."I think the correlation results for these simple Iron Condors fall under the category of "brute force is often a perfectly acceptable technique." Decent results are possible with static profit targets and static stop loss levels. Spend your time managing your trades, not overthinking your entries.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".