Over the last 40+ blog posts we took a fairly detailed look at the backtest results of 28,840 short straddles on the S&P 500 Index (

SPX). I provided a bit more detail in these 40+ posts than usual. While I didn't provide all of my analysis on the SPX short straddles, there was enough to paint a solid picture of the performance of short straddles, and how their behavior changes with implied volatility (IV) and implied volatility rank (IVR).

In this post, I won't discuss how these trades were structured and managed. For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series:

Option Straddle Series - P&L Exits.

At a high level, we tested 7 different days-to-expiration (DTE) for trade entry. For each of these DTE, we tested 8 different loss management levels (based on the credit received for selling the straddle). For each of these loss management levels, we tested 5 different profit management levels, again based on the credit received for selling the straddle. This comes out to 280 different tests for each monthly option expiration (7 x 8 x 5 = 280). We backtested all of the monthly options expirations starting in January 2007 and running through August 2015...a few more than 100 monthly options expirations...and that's how we got to the 28,840 trades. This does not include the 5 IVR filters that were tested (no filter, >25, <25, >50, <50) ... If I did, we'd need to multiply the 28,840 by 5.

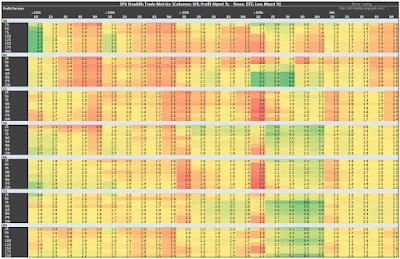

Equity Curves

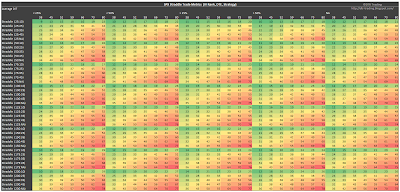

Enough of the intro, let's get into the results. Just like I've done in my prior full-summary posts, I'm including equity curves for each of the DTE. In the images below, each row is a separate DTE, starting with 38 DTE at the top, and ending with 80 DTE at the bottom. I am only including three profit taking levels (10%, 25%, and 35%) in order to fit a representative number of equity curves in this post. Also, note that the y-axis is the same across all 21 of the equity curves below.

|

| (click to enlarge) |

So what can we learn from these equity curves? Mostly common sense stuff...the trades with higher profit taking levels had the greatest returns for a given DTE. Also, the trades with the longer durations (higher DTE), in general had greater returns for a given profit taking level. Some obvious outliers in these trends occurred with the 59 DTE, 10% and 25% profit taking variations

General Trends

If you read all 40+ straddle posts, a few other patterns became apparent:

IV / IVR Scatter Plots

The higher the IV, or IVR, the larger the returns for a given trade. This makes sense, since our profit taking is tied to the credit received, and a higher IV or IVR will result in a larger credit compared to a trade entered at a lower IV or IVR. This also has an impact on our expiration breakeven points for the trade.

IV Scatter Plots

Another scatter plot pattern highlighted the fact that many trades were entered at an IV level between 10 and 30...both winning and losing trades. This also makes sense considering the range of the VIX. Coincidentally, just this week

Tastytrade had a show where they pointed out that since 1990, the VIX has traded below 15 one-third of the time. You can see this TT episode

here.

DIT Scatter Plots

A third scatter plot pattern showed that the higher the DTE and/or the higher the profit taking percentage, the longer you needed to stay in a trade. Again, this was to be expected, but it was nice to see that the data confirmed our intuition.

IVR Filtering

The most consistent IVR patterns were related to the IVR > 50% filter. In general, trades that met the IVR > 50% criteria had the highest win rates, highest P&L readings, and best profit factors. The downside? ...only about 20% of all potential trades met this IVR criteria ... so, only two or three trades per year. When you do see this filter criteria met, you should strongly consider increasing your size for these SPX short straddles.

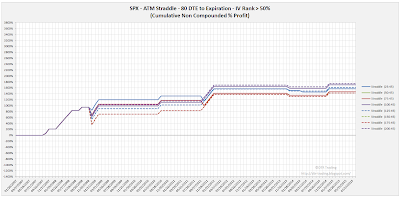

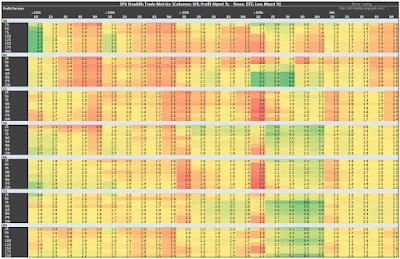

Quantitative Results

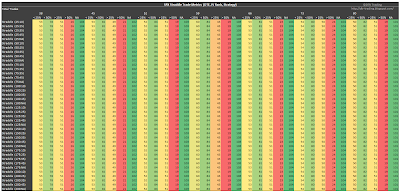

In all of the tables below, I followed the same structure as the tables in the summary posts for the individual DTE. The only difference is that the heat map coloring below evaluates all of the data, so that we can visualize the strength of IVR filters, profit taking levels, and loss taking levels across the entire data set.

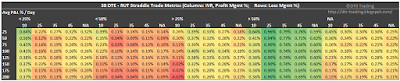

The first table shows the normalized percent P&L per day for all of the strategy variations. The variations that met the IVR > 50% filter had the highest readings. As I mentioned above, you were only able to enter these trades two or three times per year ... only two or three times per year did we see an SPX IVR level greater than 50%. Because of this limitation, you will only see these high daily return numbers for a small percentage of days during the year. Considering this, one use of the IVR filter could be as an indicator to increase your position size. Also, recently there was an interesting Tastytrade show on P&L per day and portfolio returns...you can watch it

here. Keep in mind that you need to consider days-in-trade (DIT) and the total number of trades when evaluating your portfolio returns when using the P&L per day values below.

|

| (click to enlarge) |

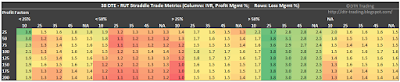

The second table shows the normalized percent P&L per trade for all of the strategy variations. Again, we see the highest per trade returns associated with the variations that met the IVR > 50% filter. There were fewer of these IVR > 50% trades, and these trades had higher win rates...resulting in high per trade returns. There was also an increased IV on entry associated with these particular trades, which resulted in higher credits for these trades.

|

| (click to enlarge) |

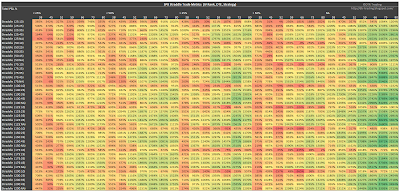

The third table shows the win rate for all of the strategy variations. The highest win rates occurred at the 10% profit taking level, regardless of IVR filter level. Most of these particular win rates were in the 90% + range. For the IVR > 50% filter, the high win rates spanned multiple profit taking levels. For the non-IVR filtered variations and the 25% profit taking level, we see many win rates at or above 80% across most DTE. For a monthly straddle trader, this isn't a bad win rate.

|

| (click to enlarge) |

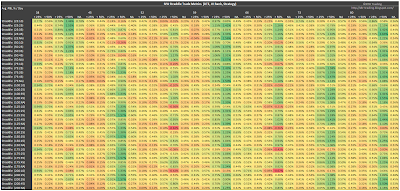

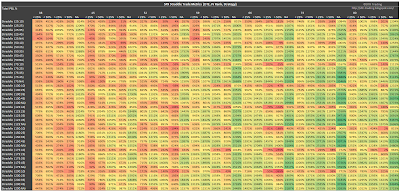

The fourth table shows Sortino Ratios for all of the strategy variations. There are clearly areas of strength for the Sortino readings, but patterns/generalizations for positive readings are not very strong/clear.

|

| (click to enlarge) |

The fifth table shows the profit factors for each of the strategy variations. In general, the highest readings occured with the variations meeting the IVR > 50% filter.

|

| (click to enlarge) |

The sixth table shows days-in-trade (DIT) for each of the strategy variations. So what do we notice...common sense again...the quicker you take profits or losses, the shorter your trade duration. Also, longer DTE variations required you to stay in your trades longer in order to hit your profit exit. In general, we can see in the table that, to collect 10% of the credit received (10% profit taking level) required a trade duration of roughly 30% of the entry DTE. At the 25% profit taking level you needed to stay in the trade around 60% of the entry DTE. For the 35% profit taking level it was about 70% of the entry DTE; 45% profit taking took your trade duration to about 80% of the entry DTE. These estimates are for the non-IVR filtered strategy variations.

|

| (click to enlarge) |

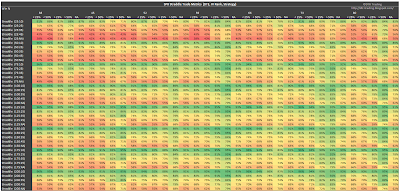

The seventh table shows the number of trades that were entered for each strategy variation. The number of trades for a particular variation, along with the DIT (previous table) have a large impact on your portfolio returns. As soon as you apply an IVR filter to trade entry, you reduce the number of trades that you take...as seen in the table below. An alternative use for the IVR filter is for position sizing (as mentioned above)...when the IVR is greater than 50%, increase your size.

|

| (click to enlarge) |

Now for the last table...total non-compounded returns by strategy variation. The non-IVR filtered variations had the highest returns, which is related to these variations having the most trades (100+, see table above). In general, the trend is for higher returns with higher DTE.

|

| (click to enlarge) |

In the past, I've made fairly granular recommendations on which strategy variations to choose based on a trader's specific risk tolerance and other factors. This time, I'm going to be more specific, and point out the variation that appeals to me. Since I use the IVR filter for sizing only, I am most interested in the non-IVR filtered strategy variations. Based on a number of factors, my preferred variation is profit taking at 25%, loss taking at 75% and DTE in the 55 to 70 range. Depending on the market, I may push the profit taking level up to 35%, but that would be as high as I'd go. Also note, that 2015 was an unusually good year for SPX short straddles....not sure I'd expect this higher than normal win rate to continue.

If you want to check out the details behind the numbers shown in the tables above, take a look at my

SPX Straddle Summary Page that lists links to all 40+ articles in the series.

It's good to have this series of articles finally finished. This has been a bear of a blog series to create, at five posts per week. Even with extensive copy and paste, which I'm sure you noticed :), each post still took in excess of two hours to write. Now I know my limit! Going forward, I am going to scale back my posts to no more than two times per week, and write more summary posts rather than detail posts. Hat tip to Mike at

Quantocracy for this suggestion!

Finally, if you like my blog, consider a tax deductible donation via my Movember page...your donation supports men's cancer research: http://mobro.co/dave2015