In this article we'll look more deeply at the following iron condor (IC) strategy variations:

- 38 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking

- 80 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking

- 80 DTE, 75 pt. wings, 12 delta shorts, 200% stop loss, 50% profit taking

These strategy variations

appeared to be the strongest based on their metrics, and the stability of their metrics. A summary of all of the articles in this series can be found

here.

Recall, that in this series of IC articles we looked at three different starting structures (see

introduction):

- Standard (ST): equal number of call spreads and put spreads

- Delta Neutral (DN): fewer call spreads than put spreads ... can better withstand up moves

- Extra Long Put (EL): same as ST, but with one extra long put ... can better withstand down moves

In the sections below, we'll look at how these three structures (ST, DN, EL) perform relative to each other in each of the three strategy variations listed at the top of this page.

Lastly, in the prior articles in this series, I used data from trades running from the January 2007 expiration through the September 2016 expiration. In this article I have expanded the results to include trades from the January 2007 expiration through the June 2017 expiration.

IC Strategy 1 (38 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking)

The equity curves for the three structures, executing trades only using the

monthly options, are shown below.

|

| (click to enlarge) |

The equity curves for the standard (ST) and delta neutral (DN) look better than the extra long put structure, with the DN looking the best. Neither the DN or ST structures really started performing well until January 2012. Overall, these equity curves at 38 DTE are pretty jagged.

The returns for each of these structures over the last 12 months of backtests are shown in the tables below.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

The July 2016 expiration hit the DN and ST structures pretty hard, but the EL structure made money during that expiration. The V bottom at the end of June triggered stop loss exits on the DN and ST structures.

The December 2016 expiration was the next losing trade, with upside stop losses being triggered (DN 8-Dec-2016, EL 25-Nov-2016, ST 7-Dec-2016). The smallest loss on this expiration occurred with the EL structure.

The March 2017 expiration was again the result of upside stop losses being triggered (DN 23-Feb-2017, EL 15-Feb-2017, ST 15-Feb-2017). The smallest loss on this expiration occurred with the DN structured.

The highest total returns for this 12 month period were associated with the EL structure, with second place going to the ST structure.

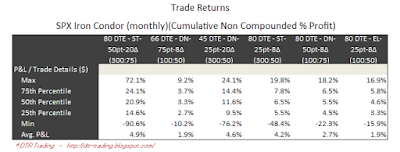

The metrics for each of the three structures are shown in the table below. There are three major groupings in this table, with each grouping containing the results for a specific structure (DN, EL, ST). For each structure, there are three rows of metrics organized as follows:

- First row - results from trades on weekly expirations from Jan 2007 through Sep 2016

- Second row - results from trades on weekly expirations from Jan 2007 through June 2017

- Third row - results from trades on monthly expirations from Jan 2007 through June 2017

|

| (click to enlarge) |

In general, the metrics are pretty stable across the different time periods and frequencies. Metrics for the last 12 months were:

- DN - win rate: 75%; average p&l/trade: 1.3%

- EL - win rate: 83%; average p&l/trade: 6.3%

- ST - win rate: 75%; average p&l/trade: 3.5%

IC Strategy 2 (80 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking)

The equity curves for the three structures, executing trades only using the

monthly options, are shown below.

|

| (click to enlarge) |

None of these equity curves look great, but the DN equity curve looks the best and has been in an uptrend since March 2009. As with the 38 DTE strategies presented first, these 80 DTE variations have fairly jagged equity curves.

The returns for each of these structures over the last 12 months of backtests are shown in the tables below.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

The trade on the September 2016 expiration was a loser for both the EL and ST structures. Upside stop losses were triggered on these trades on 8-Jul-2016 and 18-Jul-2016 respectively.

The January 2017 expiration was a loser across all three structures. Upside stop losses were triggered on all of these structures on the following dates: 1) DN 6-Jan-2017, 2) EL 21-Nov-2016, and 3) ST 7-Dec-2016.

The February 2017 expiration was a loser for the EL and ST structures. Upside stop losses were triggered on these trades on 13-Dec-2016 and 10-Feb-2017 respectively.

The last losing trades occurred on the April 2017 expiration for both the EL and ST structures. Upside stop losses were triggered on these trades on 15-Feb-2017 and 24-Feb-2017 respectively.

All of the losses on these 80 DTE trades occurred due to upside moves. Not surprisingly, the DN structure performed the best during the last year since it better handles upside moves.

The metrics for each of the three structures are shown in the table below. As mentioned above, this table first groups the metrics by structure (DN, EL, ST), and then by time period / frequency.

|

| (click to enlarge) |

The metrics for the DN and EL structures were fairly consistent across time periods and frequency. The ST structure was not as stable, specifically with its P&L/trade numbers. The Jan-2007 through Sep-2016 period had the highest returns, and these return numbers dropped significantly when the period was expanded to Jan-2007 through Jun-2017. Trading this structure on a monthly cycle reduced the per trade returns even more. Metrics for the last 12 months were:

- DN - win rate: 92%; average p&l/trade: 9.2%

- EL - win rate: 67%; average p&l/trade: 0.4%

- ST - win rate: 67%; average p&l/trade: 0.4%

IC Strategy 3 (80 DTE, 75 pt. wings, 12 delta shorts, 200% stop loss, 50% profit taking)

The equity curves for the three structures, executing trades only using the

monthly options, are shown below.

|

| (click to enlarge) |

With the lower delta short strikes and larger stop loss, the equity curves for this family of strategies were generally smoother than the prior two families of strategies. The equity curve for the DN structure appears to be the most consistent, but the curves for all of these structures have been flat to down for the last two years.

The returns for each of these structures over the last 12 months of backtests are shown in the tables below.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

The first losing trades occurred with the September 2016 expiration for the EL and ST structures. Upside stop losses were triggered on 14-Jul-2016, and 20-Jul-2016 respectively. This was a losing month with the other 80 DTE strategy for these structures as well.

The January 2017 expiration trades were losers for all three structures. Upside stop losses were triggered for all three structures: 1) DN 13-Dec-2016, 2) EL 8-Dec-2016, and 3) ST 9-Dec-2016.

The last losing trades occurred with the April 2017 expiration and were the result of upside stop losses being hit on the EL and ST structures. Both of these trades were exited on 1-Mar-2017.

All of the losses for these 80 DTE trades were again due to upside moves. The DN structure was the clear winner with the other two structures having negative returns for the last 12 month period.

|

| (click to enlarge) |

The metrics for the DN structure was fairly consistent across time periods and frequency. The EL and ST structures were not as stable, specifically with their P&L/trade numbers. The Jan-2007 through Sep-2016 period had the highest returns, and these return numbers dropped when the period was expanded to Jan-2007 through June-2017. Trading this structure on a monthly cycle reduced the per trade returns even more. Metrics for the last 12 months were:

- DN - win rate: 92%; average p&l/trade: 3.0%

- EL - win rate: 75%; average p&l/trade: -2.7%

- ST - win rate: 75%; average p&l/trade: -2.8%

Summary

I didn't really like the performance of these three families of strategies, and was a bit disappointed with their equity curves. After looking at this data, I decided to look at all 3024 strategy variations again and rank them.

I created a composite score for each of the 3024 strategy variations by equal weighting 7 metrics:

- Avg. P&L / trade

- Biggest Loss

- Avg. P&L / day

- Win %

- Sortino Ratio

- Profit Factor

- Avg DIT Winner (%DTE).

Each strategy ended up with an integer score from 2 to 92, with the possible range being 0 to 100. Using this approach, many strategies ended up having the same score. The scores of the strategy variations covered in this article were:

- 38 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking

- DN: 70

- EL: 43

- ST: 60

- 80 DTE, 25 pt. wings, 20 delta shorts, 100% stop loss, 50% profit taking

- DN: 62

- EL: 36

- ST: 73

- 80 DTE, 75 pt. wings, 12 delta shorts, 200% stop loss, 50% profit taking

- DN: 81

- EL: 81

- ST: 83

Out of the 3024 strategy variations tested, only 1512 used both stop losses and profit targets. Out of these 1512 strategy variations, only 54 have a score of 80 or greater. In the next article, we'll try to find some better performing strategy variations.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".