For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Iron Condor Series - Higher Loss Thresholds

In the trade metrics tables, I have highlighted some of the rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum margin required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

Please note that the dollar results below are based on 10 contract positions rather than the 1 contract positions used in the other posts in this series.

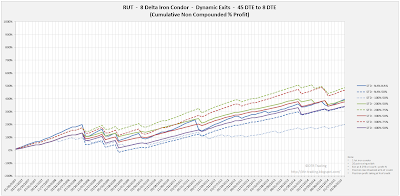

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

12 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

16 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

20 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 45 DTE tests, the highest average P&L per day readings occurred with the 16 delta short strike variations. In the next post we will look at these same deltas and exits, but on the RUT 52 DTE iron condor.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

Did you check the results for RUT 66 DTE in other time periods (2000-2007 or 1990-2000 for example). Its performance between 2007-2015 is so dramatic, wonder if that was just accidental..

Also, what brokers do you use? Your commission costs are so low...

Thanks for your comment.

I have tested with data from earlier time periods, but this earlier data has issues due to lack of liquidity: missing strikes, wide bid/ask spreads, etc.

I use thinkorswim/TD for my trading, but my commissions were lowered to my current level prior to thinkorswim'so acquisition by TD. I think you can get a similar commission schedule with TD through TastyTrade.

Thanks,

Dave

Post a Comment