For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Strangle Series - Higher Loss Thresholds

In the trade metrics tables, I have highlighted the rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

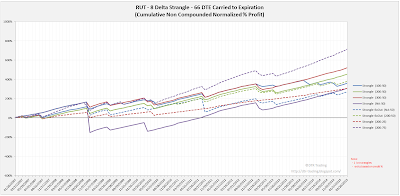

Also note, that all of the blog posts for the RUT strangle series have equity curves with identical y-axis scales, unless otherwise noted.

4 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

6 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 66 DTE tests, the highest average P&L per day readings occurred with the 6 delta short strike variations, with an average of 0.19% per day. The highest overall P&L per day reading occurred with the 8 delta 200:25 variation, at 0.26% per day. In the next post we will look at these same deltas and exits, but on the RUT 73 DTE short strangle.

Follow my blog by email, RSS feed or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

No comments:

Post a Comment