For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Straddle Series - P&L Exits.

No IV Rank Filter

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility rank (IVR) of the SPX on the date of entry. Entering these trades at 66 DTE and utilizing our loss exits and 10% credit exits (described here), resulted in the equity curves below. These equity curves are not as smooth as the 59 DTE variations and actually look more similar to the 52 DTE variations.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. Six of the eight variations have win rates at 90% or greater. The (175:10) variation had the highest P&L % / day reading, highest overall P&L % value, and a win rate of 91%.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

Below are three sets of scatter plots for selling 66 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IVR for the SPX. The IVR was captured on the day each trade was initiated. There is a trend of increasing P&L with increasing IVR, but it is not very clear because the y-axis scale. This is the same y-axis scale used in the first post of this 66 DTE straddle series.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated. Higher IV resulted in higher returns, but the majority of all trades occurred at lower IV, below 40. The bulk of the losing trades occurred at an IV below 30, but many winning trades occurred in this region as well. Also, the number of losing trades in this region decreases as the loss taking threshold is increased.

|

| (click to enlarge) |

The third image shows P&L in percentage terms versus days-in-trade (DIT). When managing losses early (25%, 50%), the losses were fairly evenly distributed across DIT. As the loss management becomes less aggressive (125%, 150%, 175%, and 200%), the loss thresholds were were rarely hit. We still had losing trades, with losses realized at expiration...but these losses were mostly less than our threshold value at expiration.

|

| (click to enlarge) |

IV Rank > 50% Filter

In this section we look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is greater than 50% ( >50% ). Entering these trades at 66 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below...not great...better than the corresponding 52 DTE equity curves, and worse than the corresponding 59 DTE equity curves.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. There are significantly fewer trades that meet the >50% IVR criteria...only 23 out of 104. The win rate was solid (at 83%) for six of the eight variations, but the total P&L % numbers were almost completely negative... mostly losers.

|

| (click to enlarge) |

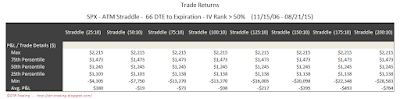

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

IV Rank < 50% Filter

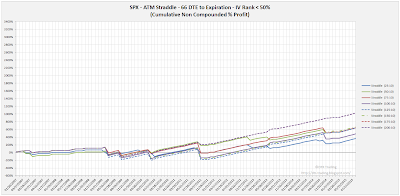

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is less than 50% ( <50% ). Entering these trades at 66 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below...which look significantly better than the IVR > 50% equity curves. These variations really started working in 2010 or 2011, depending on the loss threshold.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. Using the lower IVR filter resulted in trade metrics that were better than the non-IVR filtered and IVR > 50% strategy variations. The top performers were the (175:10) and (200:10) variations. These two variations had higher P&L per day readings, higher P&L per trade values, and higher overall P&L, and higher win rates than the non-IVR filtered and IVR > 50% variations.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

In the next post we will look at the backtest results of 66 DTE ATM SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 25% of the credit received.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

2 comments:

Great work Dave. Your research is the type of stuff hedge funds pay big money for. It is very generous of you to put it out for free to the public.

Just curious if you were going to move onto Butterfly next. The only reason I ask is because those of us with smaller accounts who don't have PM a SPX strangle is about 30K with Reg-T margin. I can get that down to 10K by putting on the wings at the 5 delta. My other option is SPY which is 6K margin, only problem with SPY is making sure you exit anything before expiry to avoid being assigned, I assume there were some trade that went the full distance. XSP is an option but low OI compared to SPY.

So basically how would the curves look with wings at the 5, 15 and 25 deta. They would reduce margin but would it reduce the profit

Thank you Iyad...I appreciate your comment.

In the past I published one article on butterflies.. I found that a balanced, no-touch butterfly is tough to make profitable. The distance between the break-even points is much smaller because of the longs, making it more likely for the market to end up outside of the butterfly's body at expiration. Hard to hit profit levels with the smaller "target".

An unbalanced fly with an adjustment strategy can work though. I've traded these, but haven't back tested them with my back test engine.

Good trading!

Dave

Post a Comment