- Strangle (100:50) - exit if the trade has a loss of 100% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (200:50) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (300:50) - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (NA:50) - exit if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle-ExOut (NA:50) - exit if the moves beyond either short strike OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle-ExOut (200:50) - exit if the moves beyond either short strike OR if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (200:25) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 25% of its initial credit OR at Expiration.

- Strangle (200:75) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 75% of its initial credit OR at Expiration.

We applied these exits to strangles constructed with different delta short strikes (4, 6, and 8 delta) at different days to expiration (45, 52, 59, 66, 73, and 80). For background information associated with the results in this post, please visit the following posts:

- Option Strangle Series - Higher Loss Thresholds

- RUT Strangle - High Loss Threshold - 45 DTE

- RUT Strangle - High Loss Threshold - 52 DTE

- RUT Strangle - High Loss Threshold - 59 DTE

- RUT Strangle - High Loss Threshold - 66 DTE

- RUT Strangle - High Loss Threshold - 73 DTE

- RUT Strangle - High Loss Threshold - 80 DTE

To get a qualitative sense of the performance of these different delta/DTE combinations, we'll first review their equity curves. Recall that the y-axis scale is the same for all of the equity curves (-600% to 1000%). The thumbnails are small, but larger images are displayed when you click on them.

|

| (click to enlarge) |

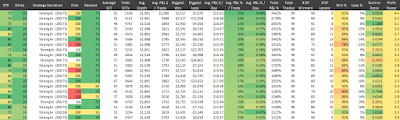

Now let's move on to the metrics. Before we do, let's review the table format that I am using to display these results. Each set of metrics is displayed as a pair of heat-map tables. The first table in the pair groups columns by DTE first, followed by short strike delta. The second table in the pair displays the same metrics, but groups columns by short strike delta first, followed by DTE. The first column of each table lists the strategy variation, including the exit used. This column uses the strategy description nomenclature that I used in the last several posts. Hopefully this makes sense, but feel free to submit a comment on this post if you'd like me to clarify the format / nomenclature further.

The image below shows the average normalized P&L per day by delta, DTE, and strategy. The highest daily returns are concentrated at the 8 delta short strikes at the higher DTE values. This can be seen by the high concentration of green on the right side of the second table of the pair of tables. Additionally, there are clusters of performance for several of the exit approaches...two of the strongest are the 200:25 and 300:50, with strength across several delta and DTE combinations.

|

| (click to enlarge) |

The second pair of tables shows the average P&L per trade by delta, DTE, and strategy. Again, the highest overall returns occur in the 8 delta region of the tables. As with the SPX strangles, the 200:75 and 300:50 have broader out-performance across delta and DTE.

|

| (click to enlarge) |

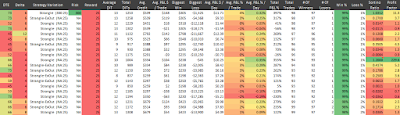

The next image shows the win percent / win rate by delta, DTE, and strategy. The highest win rates are more highly correlated to exit approach than either delta or DTE. The NA:50 and ExOut NA:50 strategies have the highest win rates...many in the high 90% range. This is the same trend that was present in the SPX strangles. Strangles are similar to iron condors in that the greater your tolerance for unrealized losses, the higher your win rate. Another point to note, a common sense point, the more profit you attempt to take out of the trade, the lower your win rate. You can see this when comparing the 200:25, 200:50, and 200:75. Lastly, the 200:25 and 300:50 variations had higher win rates than the corresponding SPX strangles.

|

| (click to enlarge) |

In the fourth pair of tables, we see the Sortino Ratio by delta, DTE, and strategy. Unsurprisingly, the highest Sortino's were associated with the lowest risk:reward exit...the 100:50. There were a couple other clusters of high Sortino's between 59 and 73 DTE with the 200:50, 200:75 and 300:50 exits. We noticed a similar trend with the SPX strangles.

|

| (click to enlarge) |

The fifth, and last, heat-map image shows the profit factor by delta, DTE and strategy. Some of the highest profit factors occurred in regions with high Sortino values.

|

| (click to enlarge) |

Besides the 13,700+ trades used to generate the results above, I backtested an additional 41,000+ RUT strangle strategy variations (with other exits and deltas). In total, I backtested more than 55,000 RUT strangle trades in all. I posted the results from these additional trades on Twitter (@DTRTrading). You can find links to all of these tweets/posts on the RUT Strangle Summary Page.

Looking at the trade metrics for all of the 55,000+ RUT short strangle trades yields additional patterns. The table below shows the top 20 strategies with the highest normalized average P&L per trade. Similar to the SPX strangles, the 73 and 80 DTE, 16 and 20 delta variations took most of the top spots. The top six spots were managed at either 200:75 or 300:75. Out of the top 20, seventeen were managed at 75% profit.

|

| (click to enlarge) |

The table below lists the top 20 strategies ordered by their win rate. Only the first strategy in the top 20 utilized a loss exit. All of the top 20 took profits at 25%. Smaller deltas were also a trait of the high win rate trades. This makes sense, since your short strikes are the furthest away from ATM, and profits are taken sooner.

|

| (click to enlarge) |

I'm still considering what I will test next...so it might be a week or so before my next post.

Also, please share my blog with other options traders, as this should reduce the plagiarism of my work...which I've heard has been increasing during the last several months.

Follow my blog by email, RSS feed or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

3 comments:

Next test should be ATM straddles. Great work so far.

Very impressive work! I'm more interested in the losing trades. We all know that there is volatility skew. Do the losing trades lose mostly because the upside is challenged? If so, do you think trading results will be better by taking less risk on the upside (eg less allocation to the call leg)?

Thank you for the comments. For my strangle tests, I did not publish these details that you asked about. You may be interested in my iron condor tests, where I did publish more information about losing trades, and unbalanced delta neutral iron condors. Here are a few articles that may be of interest:

http://dtr-trading.blogspot.com/2015/07/when-should-you-exit-your-iron-condor.html

http://dtr-trading.blogspot.com/p/blog-page_6.html

On the latter page, review my articles that are titled Put Spread / Call Spread Comparison. There is one Comparison article for each of the different DTE tested, at 8, 12, 16, and 20 delta.

Good trading,

Dave

Post a Comment