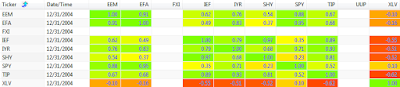

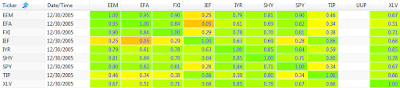

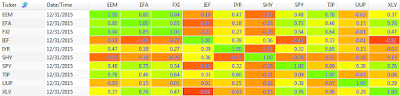

- EEM - iShares MSCI Emerging Markets Index ETF - trade-able April 2003

- EFA - iShares MSCI EAFE Index ETF - trade-able August 2001

- FXI - iShares China Large-Cap ETF - trade-able October 2004

- IEF - iShares 7-10 Year Treasury Bond ETF - trade-able July 2002

- IYR - iShares Dow Jones US Real Estate ETF - trade-able June 2000

- SHY - iShares 1-3 Year Treasury Bond ETF - trade-able July 2002

- SPY - SPDR S&P 500 Trust ETF - trade-able January 1993

- TIP - iShares Barclays TIPS Bond ETF - trade-able December 2003

- UUP - PowerShares DB US Dollar Bullish ETF - trade-able March 2007

- XLV - Health Care Select Sector SPDR ETF - trade-able December 1998

Recall that our simple momentum rotation system only looked at the 60 day/period momentum (ROC) for ranking, and picked the one ETF with the largest positive change. If all 10 of the ETFs in the group had a negative rate of change...a price today that was lower than the price 60 days ago, then the system moved to cash. The system only ranked the ETFs in the portfolio on the last trading day of the month. This is how the system shown in the past posts was structured. The associated AmiBroker afl code can be found here.

In this post, we will look at six versions of this simple system:

- 20 period momentum rotation ( ROC(20) )

- 60 period momentum rotation ( ROC(60) )

- 120 period momentum rotation ( ROC(120) )

- 20 period / 120 period momentum rotation ( ROC(20) + ROC(120) )

- 20 period / 120 period smoothed momentum rotation ( ROC(20) + MA(ROC(120), 20) )

- Weighted momentum rotation ( 0.5*ROC(120) + 0.3*ROC(20) + 0.2*HV(120) )

We will review four variations of each of these six systems, and compare their performance to that of our "standard" 60 period momentum rotation system reviewed in my previous articles. There are six equity curve charts below, one for each of the six versions listed above. Each equity curve chart contains the following four variations:

- No Ftr (No Filter - NF) - select the ETF that has the greatest ROC of the 10 ETFs; positive momentum or the smallest negative momentum (green)

- Slope Ftr (Slope Filter - SF) - select the ETF that has the greatest positive ROC of the 10 ETFs; do not select any ETF if all 10 ETFs have negative ROC -> go to cash (blue)

- Brdth Ftr (Breadth Filter - BF) - select the ETF that has the greatest ROC of the 10 ETFs; positive momentum or the smallest negative momentum; if the breadth filter (based on 200 funds) is below a threshold value -> go to cash (gold)

- Markt Ftr (Market Filter - MA) - select the ETF that has the greatest ROC of the 10 ETFs; positive momentum or the smallest negative momentum; if the S&P 500 is below the 200 day MA on the S&P 500 -> go to cash (purple)

In addition, each of the six equity curve charts contains the equity curves for two additional systems:

- Standard - our standard 60 period momentum rotation system with slope filter; no trades taken with negative momentum (red)

- S&P 500 Index - buy and hold the S&P 500 (orange)

Now let's look at the equity curves for each of the six system variations...

20 Period Momentum ( ROC(20) )

|

| (click to enlarge) |

60 Period Momentum ( ROC(60) )

|

| (click to enlarge) |

120 Period Momentum ( ROC(120) )

|

| (click to enlarge) |

ROC(20) + ROC(120)

|

| (click to enlarge) |

ROC(20) + MA(ROC(120), 20)

|

| (click to enlarge) |

Weighted System Components (3)

|

| (click to enlarge) |

For me, there were two big take-aways in reviewing these equity curves. One, all versions and variations experienced poor performance in 2015. Second, the non-filtered variations, in general, outperformed the other variations. These same two trends were present in nearly all of the other 30+ product portfolios I tested with these systems.

Finally, I thought it was interesting that just this week the following article was published via Quantpedia: Has Momentum Lost Its Momentum?

In the next post, I will share the AmiBroker system settings that I used for these tests, so that you can replicate the "standard" system results.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".