It's been a while since my

last post. I had planned on writing this particular article about three months ago, but work got in the way of my writing and testing Over the next few weeks I will try to close out this series on momentum rotation using my

60 day ROC example written for

AmiBroker. After I finish this series, I will get back to option strategy backtesting

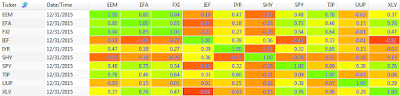

I thought it was interesting how poorly the 60 day ROC momentum rotation system performed during 2015. During this period, there were no consistent uptrends for the products traded by my example system. I believe this was the primary reason for the poor performance. I thought this might be reflected in the 250 day correlation between the products (measured at the end of each year in the test period). The correlation tables are shown below. Surprisingly, 2015 did not look dramatically different than some of the other years.

2003 - 250 Day Correlation

|

| (click to enlarge) |

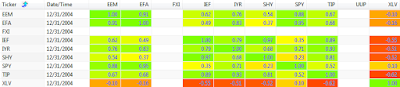

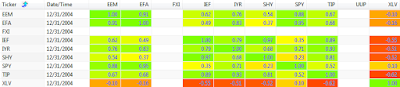

2004 - 250 Day Correlation

|

| (click to enlarge) |

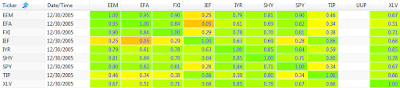

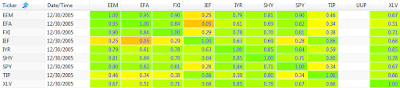

2005 - 250 Day Correlation

|

| (click to enlarge) |

2006 - 250 Day Correlation

|

| (click to enlarge) |

2007 - 250 Day Correlation

|

| (click to enlarge) |

2008 - 250 Day Correlation

|

| (click to enlarge) |

2009 - 250 Day Correlation

|

| (click to enlarge) |

2010 - 250 Day Correlation

|

| (click to enlarge) |

2011 - 250 Day Correlation

|

| (click to enlarge) |

2012 - 250 Day Correlation

|

| (click to enlarge) |

2013 - 250 Day Correlation

|

| (click to enlarge) |

2014 - 250 Day Correlation

|

| (click to enlarge) |

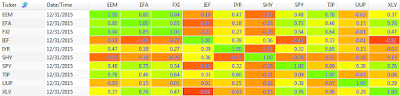

2015 - 250 Day Correlation

|

| (click to enlarge) |

2016 - 250 Day Correlation

|

| (click to enlarge) |

Next, I looked at the performance of this system from: 1) 2003 through 2014, 2) 2015 through the first three months of 2016, and 3) 2003 through the first three months of 2016. These metrics are shown in the table below.

|

| (click to enlarge) |

For 2015, there were a few metrics that jumped out at me compared to the 2003 through 2014 period:

- The win rate was much lower, so fewer winning trades than typical for this system

- The average bars held was higher for both winners and losers, so we were in the trades longer than usual before a momentum change occurred

- The maximum consecutive winners and losers was lower, indicating a market with no sectors with strong upward momentum...a zig zagging market

- The maximum trade drawdown was lower, indicating no persistent down moves before a trade was exited...weak uptrends and weak downtrends

I also reviewed

Monte Carlo simulations for this system (using the same ETF products) from 2003 through 2016. For the Monte Carlo runs, the position sizing utilized 99% of the available capital for each trade.

|

| (click to enlarge) |

The actual metrics for this simulation are shown in the table below. The backtesting and Monte Carlo simulations assumed an initial portfolio equity of $100K.

|

| (click to enlarge) |

90% of the observed annual return values were at or above 9.86%. Also in 90% of cases the drawdown was less than or equal to 31.84%. A negative return for the system should occur in less than 1% of the cases based on the data above. For the actual bactested system, the annual return was 16.9%. Even when I performed the simulations with a fixed number of shares per trade, rather than 99% of the portfolio equity, there were no negative annual return values in the Monte Carlo metrics tables. Using a fixed number of shares per trade eliminates the compounding effect.

In the next article I will show the equity curves for several other momentum rotation systems trading the same products. Do you think they will also perform poorly during 2015?

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment