I am going to show some of the output of my Option Strategy Backtester (OSB) for four backtests of an IC option strategy. In these tests, the short strikes for both the call credit spreads and put credit spreads will be at roughly the same delta.

In these backtests there will be no adjustments during the trade and no hedging to start the positions leaning one direction or another. Many of these settings are available in the backtester, but we will just look at a base case this time. Here are the OSB setup details:

(1) The backtester will start looking for trades that meet the entry DTE requirement after this date

(2) The backtester will not take any trades that will have an exit DTE after this date

(3) Some trading platforms call 80 DTE, 78 DTE (e.g., TOS). The OSB uses a DTE based on the number of days to the expiration date in the option code/opra code, which is a Saturday for indexes

(4) Some trading platforms call 8 DTE, 6 DTE (e.g., TOS)

(5) Russell 2000 Index options

(6) Four 80 DTE "no-touch" condors will be tested with their short strikes at varying deltas (8, 12, 16, and 20)

(7) The distance between the short call and long call (also, the distance between the short and long puts)

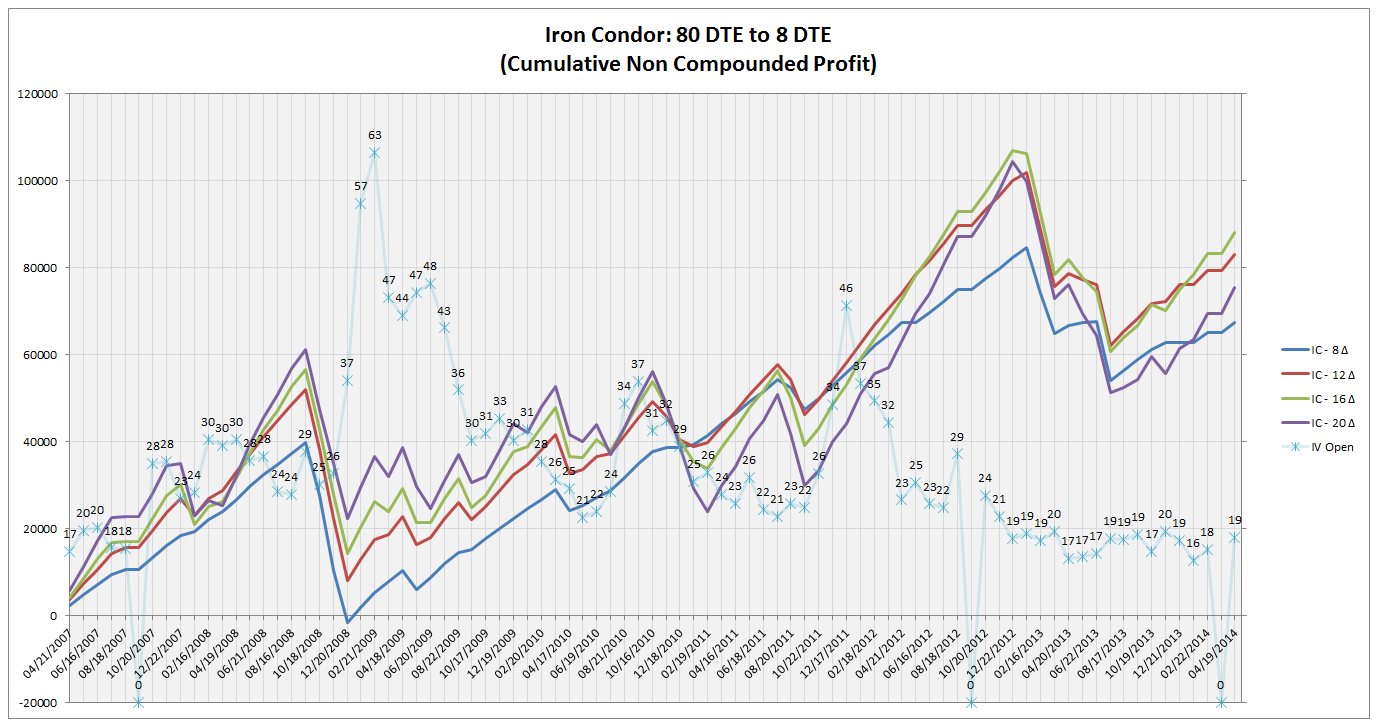

The equity curves for each of the four strategies are shown in the graph below. In addition to the equity curves, the ATM IV at trade initiation is also plotted (the average of the ATM call and ATM put). Also, the dates in the chart are expiration dates.

If I pick a random expiration date, for example 02/16/2008, we can see that when the trade was initiated, the ATM IV was 30. When the trade was closed, the cumulative non-compounded profit had grown to between $22k and $27k depending on the short delta of the strategy.

In the table below are the standard trade metrics for the four ICs with different short strikes (8 delta, 12 delta, 16 delta, and 20 delta).

There are some big drawdowns in these trades because of the lack of adjustments and hedging. No trader would put on strategies like these in any decent size. On the positive side, the percentage of winning trades and AGR are both pretty good.

We can look at just the 16 delta version of this IC in a bit more detail. In the heat map below, we can see the performance by expiration month of each of the individual trades in the 16 delta IC. The 0% cells represent expiration months were no trade was initiated. Some of these 0% cells are due to lack of data or bad prints on the trade entry day...leading the backtester to skip that month for testing.

Staying with the 16 delta IC, we can look at the P&L range (in %), range of the underlying (in %), and IV range (in %), for each for each trade by expiration month. This data is shown in the three graphs below. These graphs are essentially showing the open, which is the 0% level, the high (green bar), the low (red bar), and the value at trade close (the blue line). Also, note that the months shown on the horizontal axis are not displaying expiration dates in order to make the chart less cluttered with axis labels.

The top graph displays P&L range. You can see that when the trade closes profitably, the range is mostly on the positive of the graph, with losing trades being exactly the opposite.

The middle graph shows the range of the underlying, the RUT, in percent terms during the life of each trade. Up until early 2013, it was not uncommon for the underlying to move 10% during the 70 days that one of these trades was active. With a bullish bias for US indexes, it's not surprising to see that it is more common for the market to finish higher relative to the day the ICs were entered.

The bottom graph shows the ATM IV range and closing value in percent terms, during the life of each IC trade. IV decays to zero as we approach expiration, so you would expect these bars to be mostly red, with the closing value to be negative (the blue line). There were several times where ATM IV finished higher, and green...usually when there were market drops...as expected.

That's it for this trade.

In the next backtesting post I will look at this same IC entered at 66 DTE, two weeks later than this test. Drop me a note if you'd like to see different data presented, and I'll do my best to incorporate your suggestions in the next post or two.

No comments:

Post a Comment