For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Iron Condor Series - Higher Loss Thresholds

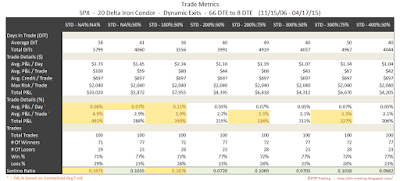

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum margin required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

For the 66 DTE, 8 delta SPX iron condors, the top exit approaches indicated by the metrics were: 200%:75%, and 300%:75%.

12 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

16 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

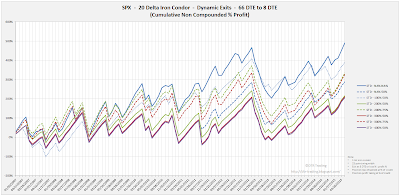

20 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 66 DTE tests, the highest average P&L per day readings occurred with the 8 delta short strike variations. In the next post we will look at these same deltas and exits, but on the SPX 80 DTE iron condor.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

Hi Dave, Thank you for the awesome research results. I really appreciate it. I am wondering if you can share some of your insights about how to adjust or roll the IC based on your research. If one wing gets tested, do you roll the untested wing further out to collect premium or roll the tested wing? Thanks in advance.

Hi Simon,

I would say that simpler is better. Rolling and adjusting might make sense in 1% of the cases (like Aug 24 of this year), but most of the time you are better off taking the profit or loss based on fixed parameters.

As soon as you adjust or roll, you change the probabilities of success for your trade, remove profit potential, or increase contract size/risk...potentially all three.

Adjusting and/or rolling might make you feel better, and may give you a false sense that you have control over your position, but the results don't show an edge...similar to most technical indicators.

Post a Comment