- Exit at 8 DTE

- ML40% - exit when the loss is equivalent to 40% of the margin for the position OR 8 DTE

- BSP - exit when the market is below the strike of the short put (BSP) OR 8 DTE

- 0.6:0.6 - exit if the trade has a loss of 60% of its initial credit OR if the trade has a profit of 60% of its initial credit OR 8 DTE

- 0.6:0.9 - exit if the trade has a loss of 60% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- 0.7:0.9 - exit if the trade has a loss of 70% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- 0.8:0.9 - exit if the trade has a loss of 80% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- Standard (STD) - an iron condor with an equal number of put and call credit spreads.

- Delta Neutral (DN) - an iron condor with fewer call credit spreads than put credit spreads in order to create a position delta near 0. This structure performs better in an advancing market.

- Extra Long Put (EL) - a Standard iron condor with one additional long put for every 10 put credit spreads. This structure performs better in a declining market.

So how did each of these variations perform? Let's review the equity curves for all of the combinations listed above, to get a qualitative sense of the performance. Recall that the y-axis scale is the same for all of the equity curves (0% - 1000%), except for the 16 and 20 delta variations of the 66 DTE trade (0% - 1400%).

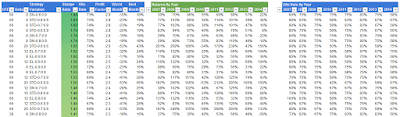

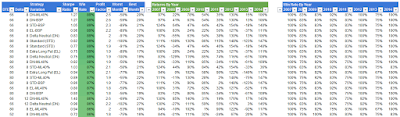

With these equity curve images in our minds, let's look at the trade metrics. The three tables below show the top 20 strategy variations (out of 336) in terms of selected metrics.

|

| (click to enlarge) |

|

| (click to enlarge) |

|

| (click to enlarge) |

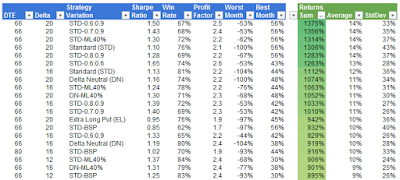

The next two tables show the top 20 strategy variations (out of 336) in terms of monthly return metrics.

|

| (click to enlarge) |

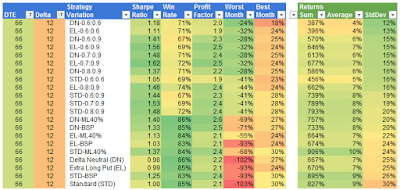

|

| (click to enlarge) |

So, which iron condor strategy is best? That depends on your goal:

- Want a high Sharpe Ratio and high profit factor - go with a 66 DTE, 8 delta short strike, using either a DN or STD starting structure. Then use a loss:profit exit of 0.6:0.9, 0.7:0.9 or 0.8:0.9. Historically, this approach produced an average profit per trade of about 5%, with a worst month loss of around 20%.

- Want a high win rate - go with a 66 DTE, 8 delta short strike, using a DN starting structure. Then either let the position go to 8 DTE with no intermediate exit or use the BSP or ML40% exit. Historically, this approach produced an average profit per trade of about 6%, but be prepared for larger drawdowns in the 50% to 90% range.

- Want the highest returns / return per trade - go with the 66 DTE, 20 delta short strike, using the STD starting structure. Then use a loss:profit exit of 0.6:0.9, 0.7:0.9, or 0.8:0.9. Historically, this approach produced an average profit per trade of about 14%, with worst month losses in the 50% to 60% range. With this approach, you would have had a profit factor over 2 and a Sharpe over 1.

- Want a low standard deviation of returns - go with a 38 DTE, 8 delta short strike using either the EL or DN starting structure. Then use a loss:profit exit of 0.6:0.6. Historically, this approach produced an average profit per trade of about 2% or 3%, with a worst month loss in the high teens.

Of all of the 336 strategy variations, my preference is for the 66 DTE, 12 delta short strike, using the STD starting structure. I like the results when this structure is managed with a loss:profit exit of either 0.6:0.9, 0.7:0.9, or 0.8:0.9...see below.

|

| (click to enlarge) |

All of the data in the tables above can be downloaded in spreadsheet form from Google Docs at:

http://dtr-trading.blogspot.com/p/dynamic-exit-iron-condor-statistics.html

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

7 comments:

Hi Sam,

Thanks for the comment. All of the tests use options with monthly expirations...no weekly options were used in my testing. All of the positions could potentially overlap depending on the exit strategy.

Thanks,

Dave

Hi Dave,

Thanks for sharing! You mentioned in a previous post you started this exercise because a previous back tested strategy wasn't performing to expectations. I assume you have been trading this strategy for the last couple months. If so, (although very short time period) has it been performing to your expectations?

Regards

Jay

Hi Jay,

I'm primarily trading strangles, but will eventually run ICs in my IRA accounts. No live data on the ICs at this time.

Thanks,

Dave

Hi Dave,

So, there is no adjustment involved?

Thanks,

JOHN

Hi John,

No adjustments...just exits based on either the profit or loss target being hit.

Thanks,

Dave

Do you have any plans to test iron flies (straddles with 10, 12, or 16 delta wings)? Based on your straddle material I would assume a 73 DTE iron fly with 35% profit target would be good in regards % return. I'm not sure if we should include a stop loss of 75% credit received though.

Thank you very much though for your material, it changed my trading parameters!

I will likely look at flies in the next series.

Thanks,

Dave

Post a Comment