For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Straddle Series - P&L Exits.

No IV Rank Filter

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility rank (IVR) of the SPX on the date of entry. Entering these trades at 52 DTE and utilizing our loss exits and 10% credit exits (described here), resulted in the equity curves below. Very solid performance for several of the variations since mid-2012.

|

| (click to enlarge) |

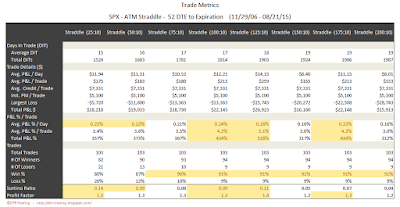

The trade metrics for these different exits are shown in the table below. A number of the variations have win rates at 91%...but all variations had trouble at the end of 2008. The (125:10) variation had the highest P&L % / day reading, highest overall P&L % value, and the highest win rate (tied with five other variations).

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

Below are three sets of scatter plots for selling 52 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IVR for the SPX. The IVR was captured on the day each trade was initiated. There is a trend of increasing P&L with increasing IVR...a trend that has repeated across all of the tests.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated. Higher IV resulted in higher returns, but the majority of all trades occurred at lower IV, below 35.

|

| (click to enlarge) |

The third image shows P&L in percentage terms versus days-in-trade (DIT). When managing losses early (25%, 50%), the losses were fairly evenly distributed across DIT. As the loss management becomes less aggressive (125%, 150%, 175%, and 200%), the loss thresholds were were rarely hit. We still had losing trades, with losses realized at expiration...but these losses were mostly less than our threshold value at expiration.

|

| (click to enlarge) |

IV Rank > 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is greater than 50% ( >50% ). Entering these trades at 52 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. There are significantly fewer trades that meet the >50% IVR criteria. This IVR criteria caused many of these variations to have negative total returns, and negative P&L per day readings...even though the win rates were nearly all 89%.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

IV Rank < 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVRof the SPX is less than 50% ( <50% ). Entering these trades at 52 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. Using the lower IVR filter improved many of the metrics over the non-IVR filtered or IVR > 50% filtered variations. The top variations in the table below had higher P&L per day readings, higher total P&L values, and higher win rates than the non-IVR filtered and IVR > 50% filtered variations...this is surprising and breaks the trend that we have seen up to this point.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

In the next post we will look at the backtest results of 52 DTE ATM SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 25% of the credit received.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

4 comments:

Been reading your studies. Very insightful. Hope you will have a summary later on to rank the best and worst returns and R/R ratio of the varies setups. Thanks for sharing.

Highlander,

Thanks for the feedback. I am summarizing the results of each DTE grouping, showing how the profit and loss exits for a given DTE compare to each other.

My plan is to test the same profit and loss exits at different DTEs: 38, 45, 52, 59, 66, 73, and 80. At the conclusion of all of these DTE tests, I will summarize all of the data in a final article. That will be about five or six weeks from now.

Thanks,

Dave

Interesting that the 52 DTE/10% strategies linger in loss territory for so long when the 38 DTE/10% and 45 DTE/10% barely brushed along the break even threshold (on the low side) and they finish close to double the return of the 52 DTE/10% strategy.

I find myself expecting liner relationships to exist both along the DTE curve and between selling of strangles and straddles and they often don't exist. Great stuff, Dave. Thanks for sharing.

There are definitely some surprises in the data.

Glad you like seeing the results...I know some folks feel like I'm providing too much detail and just want the summaries. Hopefully everyone who reads my blog will have a very solid understanding of how straddles perform after I finish.

Thanks for your feedback,

Dave

Post a Comment