For background information associated with the results in this post, please see the following posts:

- Option Straddle Series - P&L Exits

- SPX Straddle - 66 DTE - No Profit Management

- SPX Straddle - 66 DTE - Manage Profits at 10% of the Credit Received

- SPX Straddle - 66 DTE - Manage Profits at 25% of the Credit Received

- SPX Straddle - 66 DTE - Manage Profits at 35% of the Credit Received

- SPX Straddle - 66 DTE - Manage Profits at 45% of the Credit Received

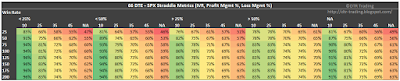

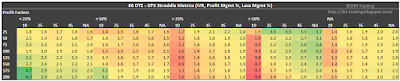

The results in this post are summarized in six heat map tables. In these tables, each row corresponds to a different loss exit percentage. For example, the first row (25) corresponds to the strategy variations where losses were taken at 25% of the credit received. These rows have values from 25 to 200. The columns are a little more complicated, and are grouped first by implied volatility rank (IVR) level, and then by profit exit percentage. You can see that each IVR percentage level contains five columns (10, 25, 35, 45, and NA)...with each column representing a profit taking percentage. For example, the first column lists all of the strategy variations where the IVR was less than 25% and profits were taken at 10% of the credit received.

The first table shows the average normalized P&L per day by IVR, profit taking percentage, and loss taking percentage. The highest daily returns are concentrated in the IVR > 50% columns, specifically the row associated with loss management at 25% and profit taking at 25%, 35%, 45%, and NA. So far, the highest P&L per day readings occurred with the 45 DTE variations at 25% and 35% profit taking. The best 66 DTE readings were lower than the best readings from the 38 DTE, 45 DTE and 59 DTE variations.

|

| (click to enlarge) |

The second table shows the average P&L per trade by IVR, profit taking percentage, and loss taking percentage. The area with the highest P&L per trade values was IVR > 50%, profit taking at 45%, and no profit management (NA). Also, as we noticed in the 59 DTE summary post, the trade returns in the IVR < 25% section with profit management at 25%, 35%, and 45% are very good. The returns in this section at 66 DTE are much better than the returns in this section for all prior DTE.

|

| (click to enlarge) |

The third table shows the win percent / win rate by IVR, profit taking percentage, and loss taking percentage. The highest win rates occur at lower profit taking levels...the lower the profit taking percentage, the higher the win rate for a given IVR grouping. This highest individual win rates (96%) occur with an IVR < 25% and profit taking at 10%. This section was also the strongest for the 38 DTE and 52 DTE trade variations. Other than this same section at 38 DTE, we have not seen win rates of 96% with any other variations of straddle testing up to this point.

|

| (click to enlarge) |

In the fourth table, we see the Sortino Ratio by IVR, profit taking percentage, and loss taking percentage. The highest Sortino Ratios were associated with loss taking at 25%. These high Sortino values were present across the filter levels of IVR > 25%, IVR > 50% and no IVR filtering. Another region of strength was associated with an IVR < 25%, across all profit taking levels, and loss taking at 175% and 200%. The best Sortinos at 66 DTE were lower than the best Sortinos at 38 DTE, 45 DTE and 59 DTE.

|

| (click to enlarge) |

The fifth table shows the profit factor by IVR, profit taking percentage, and loss taking percentage. The largest profit factor values were associated with an IVR < 25%, profit taking at 10%, and loss taking percentages of 175% and 200%. The other region of strength was associated with an IVR > 50% , profit taking at 25%, 35%, 45%, and NA, and loss taking at 25%.

|

| (click to enlarge) |

The last table shows the average days-in-trade (DIT) by IVR, profit taking percentage, and loss taking percentage. The quicker the profit taking, the shorter the time spent in a trade. Limiting your losses to 25% of the credit received also took you out of the trades sooner.

|

| (click to enlarge) |

Which variation of the 66 DTE straddle is best? That depends on your risk tolerance. If I was going to trade a 66 DTE ATM SPX straddle on a monthly basis, I would gravitate towards the non-IVR filtered version that takes profits at 25% and losses around 75%. If I just wanted to trade these more opportunistically, then I would look for trades when the IVR is greater than 50%, and manage with profit taking at 35% to 45% and loss taking at 75% to 100%. You can find links to all of my SPX straddle articles on the SPX Straddle Summary Page.

In the next post, we will start looking at the automated backtest results for the short straddle on the SPX at 73 DTE.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

2 comments:

Fascinating as always! Thanks for sharing these each day. (PS just want to make sure you got my email via the contact page)

Kirk...thank you for the feedback...I appreciate it!

BTW, I did get your email and just sent you a response.

Post a Comment