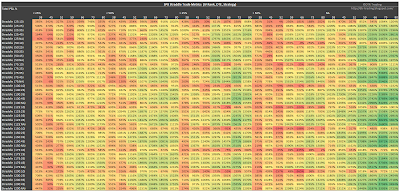

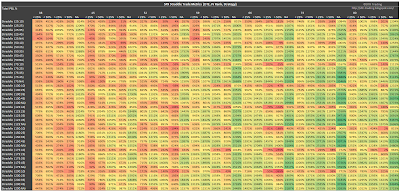

Below, you'll see the same trade metrics that I presented in my last post, but organized with the strategy variations in rows. For each trade metric category I've included two tables. The first table in each category has the DTE columns grouped by IVR. For example, the first seven DTE columns are associated with an IVR of < 25%. The second table in each category switches the groupings between DTE and IVR. For example, the first five IVR columns in the second table are associated with trades initiated at 38 DTE. Since I already discussed these results in my last post, I won't spend a lot of time describing the results below. On to the results...

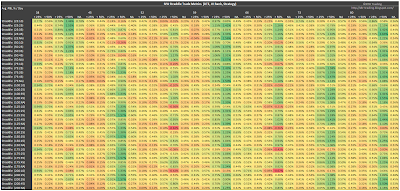

P&L Per Day

As we noticed in the first article, the largest P&L per day metrics are associated with an IVR > 50%. Recall that only two or three trades per year met this IVR filter criteria...so the green cells are associated with significantly fewer trades than the other cells...this could be a pro or a con depending on how you use this information.

|

| (click to enlarge) |

|

| (click to enlarge) |

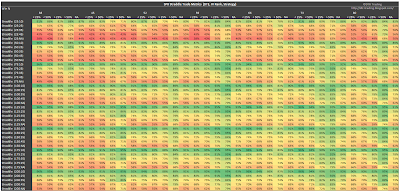

P&L Per Trade

Same as above, the trades that met the IVR >50% criteria had the highest P&L per trade numbers. Only about 20 trades out of 100 met the IVR >50% criteria. For the non-IVR filtered category (NA), all 100+ trades were entered.

|

| (click to enlarge) |

|

| (click to enlarge) |

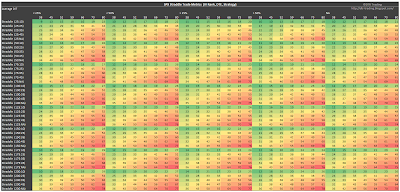

Win Rate

The profit taking at 10% of the credit received, stands out in the tables below, although maybe not as clearly as in the win rate table in the last post.

|

| (click to enlarge) |

|

| (click to enlarge) |

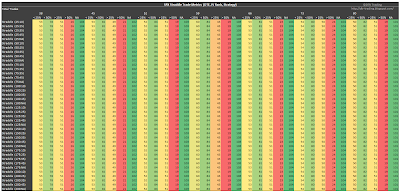

Sortino Ratio

Columns of strength are apparent in the two tables below. The clustering of strength seems a bit more clear in the Sortino table in the last article.

|

| (click to enlarge) |

|

| (click to enlarge) |

Profit Factor

Obvious columns of strength again. Typically associated with the IVR >50% filtered trades.

|

| (click to enlarge) |

|

| (click to enlarge) |

Days In Trade (DIT)

The second table highlights the obvious, that the shortest DIT are associated with the trades entered at the lowest DTE. As the profit taking levels are increased, the trade duration is extended. This information can be utilized in many different ways.

|

| (click to enlarge) |

|

| (click to enlarge) |

Number Of Trades Entered

You'll enter the most trades (over 100) if you don't use the IVR filter...the second most trades occurred with the IVR <50% filter. As I mentioned in the last article, one approach for the IVR >50% filter could be as an indicator to increase position size for the 20% of trades that meet this criteria.

|

| (click to enlarge) |

|

| (click to enlarge) |

Total P&L

The greatest total P&L numbers occurred with the non-IVR filtered trade variations.

|

| (click to enlarge) |

|

| (click to enlarge) |

If you want to check out the details behind the numbers shown in the tables above, take a look at my SPX Straddle Summary Page that lists links to all 40+ articles in the series.

Also, today and tomorrow I will tweet (@DTRTrading) tables that only show the heat map results for the non-IVR filtered trades. These might be interesting to traders that enter trades every month.

Next week, I will start looking at the short straddle on the RUT.

If you like my blog, consider a tax deductible donation via my Movember page...your donation supports men's cancer research: http://mobro.co/dave2015

3 comments:

So glad you are going to look at the short straddle on the RUT! Thanks so much for all your work!

awesome some stuff, itd be nice to see a iron butterfly study, in the previous one you did the results were not profitable, makes me wonder about all my buttersi have on. lol =D

Hi Dave

Big thanks again for publishing your hard work. I know that you trade strangles. Could you explain why strangles not straddles? Is it because volatility isnt high enough? If you are looking for backtest ideas maybe try naked puts also strangle or straddle on NDX or DAX where volatility and premium is always higher.

Good trading to you

Marcin

Post a Comment