This post reviews the backtest results for 4160 options straddles sold on the RUT at 66 days-to-expiration (DTE). Eight different loss approaches were tested on these straddles. On top of these eight loss approaches, tests were conducted with no profit taking, and profit taking at 10%, 25%, 35%, and 45% of the credit received. In future articles, the performance of trades initiated at 73 DTE and 80 DTE will be explored. You can find the prior RUT straddle summary posts at the links below:

- RUT Straddle - 38 DTE - Results Summary

- RUT Straddle - 45 DTE - Results Summary

- RUT Straddle - 52 DTE - Results Summary

- RUT Straddle - 59 DTE - Results Summary

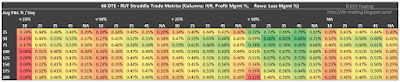

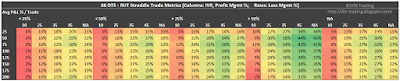

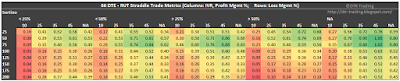

The results for these backtests are summarized in six heat map tables. In these tables, each row corresponds to a different loss exit percentage. For example, the first row (25) corresponds to the strategy variations where losses were taken at 25% of the credit received. These rows have values from 25 to 200. The columns are a little more complicated, and are grouped first by IV rank (IVR) level, and then by profit exit percentage. You can see that each IVR percentage level contains five columns (10, 25, 35, 45, and NA)...with each column representing a profit taking percentage. For example, the first column lists all of the strategy variations where the IVR was less than 25% and profits were taken at 10% of the credit received.

The first table shows the average normalized P&L per day by IVR, profit taking percentage, and loss taking percentage. We see the familiar pattern of the IVR > 50% level outperforming the other IVR levels in terms of P&L per day. The highest daily returns were concentrated in the 45% profit taking level with IVR > 50%, and also the 50% and 75% loss taking levels with IVR > 50%. The top strategies were the (50:25) and the (50:45) using the IVR > 50% filter.

|

| (click to enlarge) |

The second table shows the average P&L per trade by IVR, profit taking percentage, and loss taking percentage. The IVR > 50% level had the highest P&L per trade readings, with the 45% profit taking level and NA level having the greatest strength. The top strategy was the (50:45) variation using the IVR > 50% filter.

|

| (click to enlarge) |

The third table shows the win percent / win rate by IVR, profit taking percentage, and loss taking percentage. The lower the profit taking percentage, the higher the win rate for a given IVR grouping. The highest win rates occur with profit taking at 10%. This 10% level had the highest win rates using the IVR > 25% and IVR > 50% levels.

|

| (click to enlarge) |

In the fourth table, we see the Sortino Ratio by IVR, profit taking percentage, and loss taking percentage. The Sortinos at 66 DTE follow a similar pattern to the Sortinos at 59 DTE...there is strength across IVR groups at the 25%, 50%, and 75% loss taking levels. The region of greatest strength is the non-IVR filtered group...this group contained the largest Sortino Ratios that we've seen across all of the RUT straddle backtests up to this point. The largest value was 1.05 for the non-IVR filtered (50:45) variation.

|

| (click to enlarge) |

The fifth table shows the profit factor by IVR, profit taking percentage, and loss taking percentage. There is again strength across IVR groups within the loss taking levels of 25%, 50%, and 75%. The region of greatest strength was the IVR > 50% group. The largest value was 5.5 with the (50:45) variation in the IVR > 50% group.

|

| (click to enlarge) |

The last table shows the average days-in-trade (DIT) by IVR, profit taking percentage, and loss taking percentage. Quicker profit taking, translates into shorter time in the trade.

|

| (click to enlarge) |

Which variation of the 66 DTE RUT straddle is best? The (50:45) variation stands out in all of the metrics above. Personally, this profit taking level is too aggressive for my style of trading. Although I do appreciate the risk:reward ratio for this variation...which is close to risk one to make one, with a 74% win rate for the non-IVR filtered variation.

If I was going to sell a 66 DTE ATM RUT straddle every month, I would likely go with the non-IVR filtered variation ... taking profits between 25% and 35%, with a loss threshold of 75%. This would put the lower bounds of my gains at 33% of my losses (25/75). The win rate would be between 81% and 87%, profit factor between 3.0 and 3.4, and a P&L per trade between 20% and 27%.

Based on all of my SPX and RUT straddle backteests, an IVR of greater than 50% occurs during only about 20% of all possible monthly trade entries. When this occurs at a 66 DTE trade entry, I would increase my trade size and take profits closer to 25% than 35%, and move by loss taking level to 50%.

You can find links to all of my RUT straddle articles, and RUT straddle tweets on the RUT Straddle Summary Page. In the next post, we will look at the automated backtest results for the short straddle on the RUT at 73 DTE.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment