Over the last several posts we reviewed the backtest results for Iron Condors initiated at 80 days to expiration (DTE) on the Russell 2000 Index (

RUT). To be consistent with all of the earlier backtests posted on this blog, we looked at 80 DTE Iron Condors initiated with short strikes at four different locations: 8 delta, 12 delta, 16 delta, and 20 delta. To read the prior dynamic exit posts, please visit the summary page:

Dynamic Exit Iron Condor Articles.

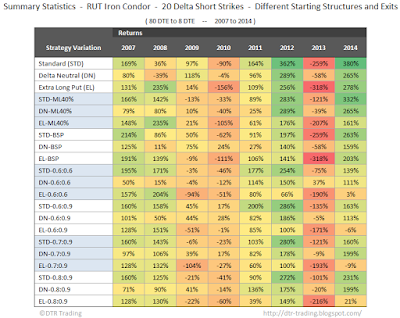

For each of these four different short strike deltas, we tested three different starting structures, with six different dynamic exits. These various combinations, resulted in 21 separate 8 year tests

for each delta when also including the three baseline (non-exited) tests. Lastly, each 8 year test contained 94 unique trades.

To review, the three RUT Iron Condor starting structures were composed of 20 point wide credit spreads with short strikes at the specified delta mentioned above, and defined as:

- Standard (STD): 10 put credit spreads, and 10 call credit spreads.

- Delta Neutral (DN): 10 put credit spreads, and from 5 to 10 call credit spreads - the number is adjusted at trade initiation to create a delta neutral Iron Condor.

- Extra Long Put (EL): 10 put credit spreads, 10 call credit spreads, and 1 extra long put.

The three categories of dynamic exit tested were:

- ML40% - this is a Margin Loss % Exit. Trades using this exit strategy either exit at 8 DTE OR if the trade has a loss greater than 40% of the margin requirement for the trade. (ML40% = Max Loss 40%)

- BSP - this is a Price Movement Exit. Trades using this exit strategy either exit at 8 DTE OR if the price of the underlying (RUT) moves below the strike of the short put. (BSP = Below Short Put).

- 0.6:0.6 - This is an Initial Credit % Loss/Profit Exit. Trades using this exit strategy either exit at 8 DTE OR if the trade has a loss of 60% of its initial credit OR if the trade has a profit of 60% of its initial credit. This can also be viewed as a Risk:Reward ratio; risking 60% of the credit to make 60% of the credit. A 0.7:0.9 variation would mean that the strategy is risking 70% to make 90%...taking a loss at 70% of the initial credit or taking a profit at 90% of the initial credit or exiting at 8 DTE if neither of the prior two criteria were satisfied.

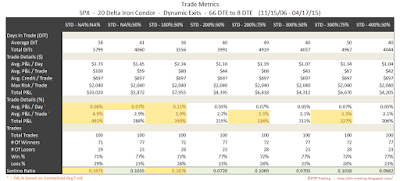

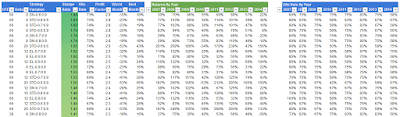

The test results are summarized in the tables below. with one table for each of the four short strike deltas. The "Strategy Variation" column uses the nomenclature listed above in order to distinguish between the different iron condor variations.

|

| (click to enlarge) |

The pattern that we observed in the prior DTE tests, again holds true for the 80 DTE tests. For the 8 delta Iron Condor options strategy variations, the win rates were highest with the non-dynamically exited, the ML40%, and the BSP versions. You can also see the trend that the Initial Credit %Loss/Profit exits greatly reduced the "worst month" losses, with all of these losses either in the high teens

or high 20% range. This reduction in the "worst month" values came at the cost of a reduced the win rate. The largest annualized monthly returns went to the STD, STD-ML40%, and STD-BSP variations. Across each exit approach, the STD variations were the top performers in terms of average return...a pattern we observed in other DTE tests as well!

|

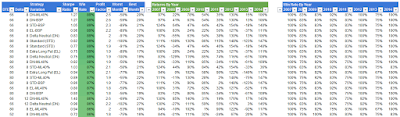

| (click to enlarge) |

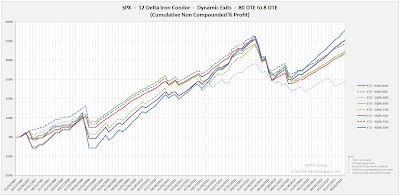

For the 12 delta Iron Condor variations, the highest Sharpe Ratios occurred with the Profit/Loss exits of 0.6:0.9, 0.7:0.9, and 0.8:0.9. The highest win rates and worst months went to the non-dynamically exited, the ML40% and BSP variations...the same pattern we noticed in the 8 delta strategies, and in the corresponding 38, 52, and 66 DTE strategies. The largest annualized monthly returns went to the STD, STD-BSP, and STD-0.8:0.9 variations.

|

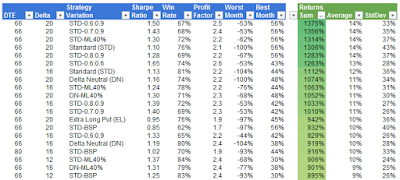

| (click to enlarge) |

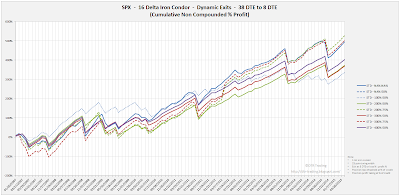

The 16 delta variations continued the same win rate and worst month pattern that we observed in the 8 and 12 delta variations, although not as pronounced. At 16 delta, we see the STD Profit/Loss exit variations have pretty bad worst month numbers. The largest annualized monthly returns went to the STD-BSP variation, with the STD and the STD-0.6:0.9 variations in second and third place respectively.

|

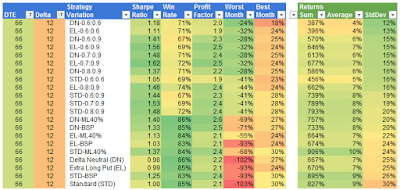

| (click to enlarge) |

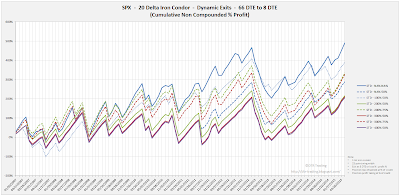

At 20 deltas, the worst month and win rate patterns were still present, although these patterns continued to break down. The highest Sharpe Ratio was 0.96 and went to the STD-0.6:0.6 variation. The largest annualized monthly returns went to the STD-0.6:0.9 variation, followed by the STD and STD-ML40% variations.

Across all of the 80 DTE Iron Condor strategy variations, it is clear that the Risk:Reward exits had a significant positive impact on the "worst month" values. One pattern that was fairly clear at 80 DTE (as well as other DTE) was the general out-performance of the STD structure over the DN and EL structures. If I was forced to trade one of these 80 DTE strategies "as is" with no adjustments, I would pick one of the 8 or 12 delta strategies using a risk:reward exit, likely one of the STD-0.8:0.9 or STD-07:0.9 variations...the same variations I chose at 66 DTE.

All of the data in the tables above can be downloaded in spreadsheet form from Google Docs at:

http://dtr-trading.blogspot.com/p/dynamic-exit-iron-condor-statistics.html

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.