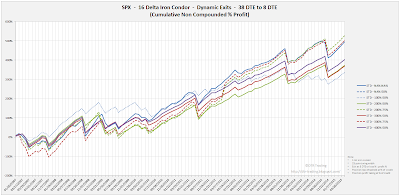

This post looks at a standard (STD) one-lot iron condor on the S&P 500 Index (SPX), initiated at 38 days-to-expiration (DTE). The results displayed below represent data from approximately 3200 individual trades entered by the backtester. The results are separated by the delta of the short strikes.

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum margin required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

12 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

16 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

20 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

In the next post we will look at these same deltas and exits, but on the SPX 52 DTE iron condor.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

thanks a lot for your backtest

now i will change my entry to 20 delta instead of 10 delta

for 38~dte SPY IC and exit to na/50/8dte

your research will help people with their trading results

keep up the good work :)

Thanks for your comment Albert!

Post a Comment