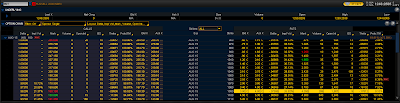

A short Strangle is essentially a short iron condor, but without the long strikes. Since the long strikes are missing, the strategy has undefined risk. Let's look at some examples, based on the RUT options closing prices on July 2, 2015. On this date, the August options were expiring in 48 days (48 DTE), which is close to our typical trading window. The put and call strikes below are available to construct our Strangles. In these images, you can see many of the important attributes for each option, including delta, price, and probabilities.

|

| (click to enlarge) |

|

| (click to enlarge) |

Since the future back test results posts will look at Strangles at 4, 6, and 8 delta, I'll use these strikes in my examples below. I will show examples of Strangles at each of these deltas, as well as Iron Condors at these deltas. Notice the absence of long strikes in the Strangles, as well as the theta, credit, and risk. Here we go...

RUT 4 Delta Strangle

|

| (click to enlarge) |

- Portfolio Margin Req: $3,708

- Delta: 0.02952

- Theta: 17.51878

- Credit Received: $335

- Risk: undefined

RUT 4 Delta Iron Condor

|

| (click to enlarge) |

- Portfolio Margin Req: $1,123

- Delta: -1.08191

- Theta: 4.38734

- Credit Received: $110

- Risk: $1,890

RUT 6 Delta Strangle

|

| (click to enlarge) |

- Portfolio Margin Req: $4,251

- Delta: -0.48099

- Theta: 22.50901

- Credit Received: $490

- Risk: undefined

RUT 6 Delta Iron Condor

|

| (click to enlarge) |

- Portfolio Margin Req: $1,184

- Delta: -1.80523

- Theta: 5.16398

- Credit Received: $155

- Risk: $1,845

RUT 8 Delta Strangle

|

| (click to enlarge) |

- Portfolio Margin Req: $4,809

- Delta: -1.48944

- Theta: 27.56221

- Credit Received: $675

- Risk: undefined

RUT 8 Delta Iron Condor

|

| (click to enlarge) |

- Portfolio Margin Req: $1,221

- Delta: -3.20900

- Theta: 7.27385

- Credit Received: $247

- Risk: $1,753

Across the board, we see higher compensation for increased risk. Since we don't buy longs for Strangles, we have a greater credit received. In addition, since we don't have long strike in a short Strangle, we have higher theta. So, in exchange for undefined risk, we receive much higher credits, and much greater theta...we get paid more and the money comes in faster.

With a strangle, we need to be more aggressive at loss management...we can't let these trades get away from us, or we could potentially have huge losses.

In the next post, I will describe the exits that will be backtested, and some trade setup details.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

No comments:

Post a Comment