For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Strangle Series - Higher Loss Thresholds

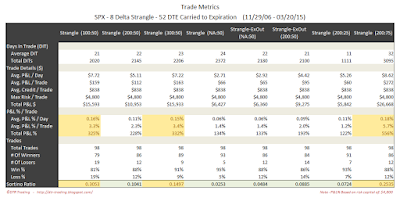

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

Also note, that all of the blog posts for the SPX strangle series have equity curves with identical y-axis scales.

4 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

6 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 52 DTE tests, the highest average P&L per day readings occurred with the 4 delta short strike variations. In the next post we will look at these same deltas and exits, but on the SPX 59 DTE short strangle.

You can follow my blog by email, RSS feed or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

No comments:

Post a Comment