For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Strangle Series - Higher Loss Thresholds

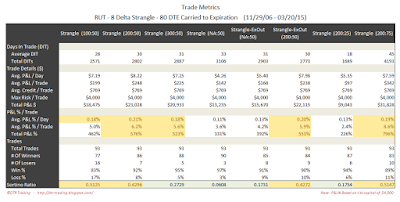

In the trade metrics tables, I have highlighted the rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

Also note, that all of the blog posts for the RUT strangle series have equity curves with identical y-axis scales, unless otherwise noted.

4 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

6 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 80 DTE tests, the highest average P&L per day readings occurred with the 8 delta short strike variations, with an average of 0.17% per day. The highest overall P&L per day reading was 0.21% per day and was tied between the 6 delta 200:75 variation and the 8 delta 200:50 variation.

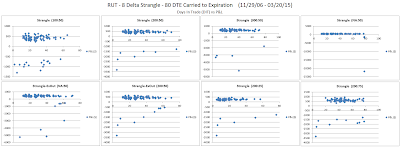

Below are three images of scatter plots for the 80 DTE 8 delta short strangles. The first image contains one scatter plot per strategy and shows P&L in dollar terms versus days-in-trade (DIT). There is one visible trend in this set of scatter plots: the largest losses tend to occur at lower DIT values for trades with a loss based exit. This is consistent across different DTE entries.

|

| (click to enlarge) |

The second image shows P&L in terms of the initial at-the-money (ATM) implied volatility (IV) of the RUT. This ATM IV was captured on the day each trade was initiated. In general, there is a trend that higher P&L numbers are associated with higher ATM IV numbers...similar to the 45 DTE scatter plots. This trend is also consistent across different DTE entries.

|

| (click to enlarge) |

The last image shows P&L in terms of the initial IV Rank for the RUT. The IV Rank was captured on the day each trade was initiated. In general, there is a trend that higher IV rank is associated with higher P&L. Also, if you trade only when IV rank is higher, you can eliminate many losing trades. Both of these trends were visible in the 45 DTE scatter plots as well. This is also consistent across different DTE entries.

|

| (click to enlarge) |

In the next post I will summarize the results for the RUT short strangle strategy.

FYI, I am posting results for higher delta strangles (at the same DTEs), as well as 8 additional exits on my Twitter feed...I am not posting these additional results to the blog.

As always, feel free to use any of the images/information on my blog...just be sure to reference this blog when sharing the information with others.

Follow my blog by email, RSS feed or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

Dave,

Again thanks for sharing your back testing results. Great stuff.

Wondering if there’s a place on the blog you can direct me to that explores condors (and/or strangles) on SPX vs /ES? Would be interesting to see how portfolio margin treats SPX vs ES and the differences in premium yields and perhaps the behavior variance of delta and theta (though I’d guess those greeks might be fairly parallel).

I realized that’s double the data storage burden and may not be simple thing.

Hi MIchael,

I have not tested options on futures, mainly due to the difficulty in acquiring this type of data.

When I have traded options on futures, I found the liquidity, bid/ask spread, and commissions to be prohibitive relative to their index counterparts (SPX, RUT, NDX).

Also, I haven't noticed much of a difference between PM on the indices and SPAN on futures options.

Thanks,

Dave

Post a Comment