For some background on how the results are presented and to read my prior dynamic exit posts, please visit the summary page: Dynamic Exit Iron Condor Articles.

As discussed in the two overview posts on the summary page above, we will look at the same three Iron Condor starting structures that have been backtested on this blog: Standard (STD), Delta Neutral (DN), and Extra Long Put (EL).

In this post we will only look at the Initial Credit % Profit/Loss Exit on each of the three starting structures:

- 0.6:0.9 - This is an Initial Credit % Profit/Loss Exit. Trades using this exit strategy either exit at 8 DTE OR if the trade has a profit of 90% of its initial credit OR if the trade has a loss of 60% of its initial credit. This can also be thought of as risk:reward; risking 60% to make 90%.

This equity curve chart below is similar to the equity curves in my prior posts. In the chart below, all of the STD Iron Condor versions have blue equity curves, all of the DN Iron Condor versions have green equity curves, and all of the EL Iron Condor versions have red equity curves. The solid lines represent the equity curves for the "no touch" version, while the dashed lines represent the equity curves for the dynamically exited versions.

|

| (click to enlarge) |

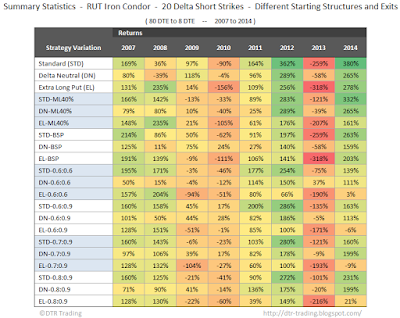

The dynamic exit versions tested were closed at either 8 DTE or a profit of 90% of the initial credit received. The parameters that varied were the risk or loss amount. The trades were closed for a loss if the loss was either 60%, 70%, or 80% of the initial credit received. In these backtest results, the Standard Iron Condor options trading strategy (STD) versions did not outperform all of the Delta Neutral (DN) and Extra Long Put (EL) versions...two DN versions slipped into the third and fourth positions The two top performers in terms of overall return were the STD-0.6:0.9 version, and the STD version without a dynamic exit respectively. The STD-0.6:0.9 version closed at either 8 DTE, a profit of 90% of the initial credit received, or a loss of 60% of the initial credit received.

The results by year, for each of the 80 DTE, 20 delta short Iron Condor options trading strategy versions are shown in the table below.

|

| (click to enlarge) |

The details associated with each of the starting structure backtests can be found in the posts below:

- Standard Iron Condor - RUT - 80 DTE

- Delta Neutral Iron Condor - RUT - 80 DTE

- Extra Long Put Iron Condor - RUT - 80 DTE

In the next post I will summarize the dynamic exit results for the 80 DTE Iron Condor options trading strategies and show the associated trade statistics.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

3 comments:

Hi Dave, I am not sure how to interpret the total profit or % profit from your graphs. I know that you have explained these briefly several times, but it is not very clear to me (and to many I think). For example, is your capital requirement for 80 DTE condors 3 times more than the 24 DTE condors, since at any time you'd be running 3 of 80 DTE condors? How does that affect your calculation of cumulative and % profit? I think if you could make one post just explaining this whole profit calculation/capital appreciation part in detail, that would make your awesome blog even more awesome :) thanks...

Hi Anonymous,

The return percentages are based on the maximum risk associated with a given test run. For example, if we look at the STD condor at 80 DTE with 20 delta short strikes, there were 91 trades entered between the 4/21/07 and 1/17/15 expirations (inclusive). Across all of these 91 trades using 10 contracts, the average risk (reg t margin) was $13,555. The maximum was $14,650 and the minimum was $12,400. To calculate the normalized percentage returns, I used the maximum value ($14,650) in the denominator. The numerator was the actual dollar profit or loss on the trade.

The margin numbers were not modified based on DTE.

Hope this helps.

Thanks,

Dave

Thanks Dave. Just one more question.When I look at your cumulative non-compounded profit graphs, RUT 66 DTE has grown to almost 140,000 and RUT 31 DTE has grown to almost 85,000 (20 deltas). These calculations are based on 10 contracts. But if someone wants to invest the same amount of starting capital (as opposed to same number of contracts), would one not be able to sell almost twice the number of 31 DTE condors than 66 DTE (for example, if the margin req is 15000 for 10 contracts and he has 30000, he can sell 20 31 DTE, but only 10 66 DTEs, because come next month, the 31 DTE capital is freed, but 66 DTE is tied up). So, my question is, for the SAME CAPITAL, would not the cumulative profit be actually higher for shorter duration condors? Thanks...

Post a Comment