|

| (click to enlarge) |

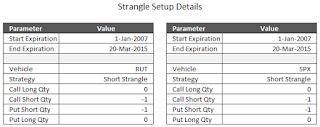

These short Strangles will be entered at six different days-to-expiration (DTE): 45, 52, 59, 66, 73, and 80. For each of these DTE, we will test selling Strangles with short strikes at three different delta: 4, 6, and 8.

The core of this series is related to the exits. The following 8 exits will be tested:

- Strangle (100:50) - exit if the trade has a loss of 100% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (200:50) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (300:50) - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (NA:50) - exit if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle-ExOut (NA:50) - exit if the moves beyond either short strike OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle-ExOut (200:50) - exit if the moves beyond either short strike OR if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR at Expiration.

- Strangle (200:25) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 25% of its initial credit OR at Expiration.

- Strangle (200:75) - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 75% of its initial credit OR at Expiration.

To clarify how these exits function, let's look at an example of the Strangle-ExOut (200:50) variation. In this example, lets assume the RUT is at 1200, and our strangle short strikes are 1100 for the puts, and 1300 for the calls. If we sell a 1-lot Strangle for $200, we would take our loss when the Strangle had to be bought back at $600. $600 - $200 = $400, or a loss of 200% or our initial credit. For this example, our profit taking would occur when we could buy back the Strangle for $100. $200 - $100 = $100, or 50% or our initial credit. Our other loss exit would occur if the RUT dropped below 1100, or went above 1300. This price movement exit would only trigger if the prior loss related exit had not yet triggered.

These exits can also be thought of as risk:reward exits. Using the prior example of the Strangle-ExOut (200:50), we are risking 200% to make 50%. These odds don't sound great from a classical stock strategy approach, but the win rate and probabilities of exit are key components of the Strangle strategy's profitability.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

8 comments:

You should add 12 , 16, and 20 delta

I might look into higher delta strangles in another series.

With the higher risk associated with naked strangles, I'll first look at strikes further away from the money...which aligns with how I personally trade strangles.

Thanks for your comment.

Dave

200%:75% is an improvement vs the Iron Condors, but still waiting to see more realistic profit exit targets that traders use in the real world, i.e. 80%, 90%, 95%, 99%, 100%, etc.. Over relying on the probabilities of winning is how one acquires a fat left tail.

Take a look at my twitter feed for other exit combinations and short strike deltas. In total I backtested 10K trades per DTE for the SPX strangles.

Hello David! Congratulations for your job! I am a rookie. How to set the delta 4 or 6 etc etc.? I have to look at the current price? I use IB. Could you help me to understand how to do?

Walter,

You'll need to learn how your trading platform displays delta. Best bet is to read their documentation or give your broker a call.

Selling a 4 delta strangle means selling a 4 delta put and selling a 4 delta call.

Thanks,

Dave

Hi Dave, first off, this is fantastic. Really thankful that you share your backtests. But I would like to understand the following details with regard to entry, number of positions and equity curve:

1. For each equity curve, do you make onyl one trade at a time and wait for it to be closed before putting on a new one or do they overlap?

2. If they overlap, how do you decide how many trades to open?

3. Are there more trades put on for the scenarios with shorter DTE or do you keep the number of trades the same across the different scenarios? If you keep the number equal it is not surprising that the longer DTE leads to a better performance. But if you can put on more trades because you use shorter DTE and they come off quicker, I would expect that 45 days would outperform e.g. 60 days. Can you clarify this point?

4. How do you calculate P&L per trade in %? Based on the buying power reduction? What do you base % on?

Would be great to get these questions clarified. Thanks!

Best

Phil

Phil,

Thanks. Take a look at my FAQ page, I think all of your questions are answered there.

http://dtr-trading.blogspot.com/p/dtr-trading-faq_23.html

If you have other questions after reading my FAQ, let me know.

Thanks,

Dave

Post a Comment