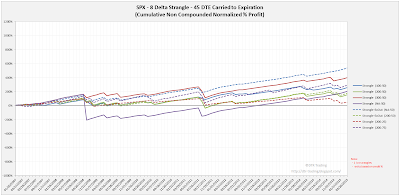

This post looks at a one-lot strangle on the S&P 500 Index (SPX), initiated at 45 days-to-expiration (DTE). The results displayed below represent data from 2300 individual trades entered by the backtester. The results are separated by the delta of the short strikes.

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

4 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

6 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

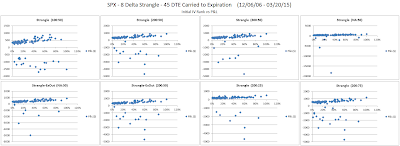

Below are three images of scatter plots for the 45 DTE 8 delta short strangles. The first image contains one scatter plot per strategy and shows P&L in dollar terms versus days-in-trade (DIT). There are a couple of visible trends in this set of scatter plots: 1) in general, the longer a trade is held, the higher the profit, and 2) the largest losses tend to occur at lower DIT values for trades with a loss based exit.

|

| (click to enlarge) |

The second image shows P&L in terms of the initial at-the-money (ATM) implied volatility (IV) of the SPX. This ATM IV was captured on the day each trade was initiated. In general, there is a trend that higher P&L numbers are associated with higher ATM IV numbers.

|

| (click to enlarge) |

The last images shows P&L in terms of the initial IV Rank for the SPX. The IV Rank was captured on the day each trade was initiated. In general, there is a trend that higher IV rank is associated with higher P&L. Also, if you trade only when IV rank is higher, you can eliminate many losing trades.

|

| (click to enlarge) |

In the next post we will look at these same deltas and exits, but on the SPX 52 DTE short strangle.

You can follow my blog by email, RSS or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

6 comments:

Looking at your first chart with the cumulative profit (equity curve), it looks like the 300:50 (best low delta) strategy experienced a vicious draw-down during 2011. Would it smooth the equity curve to place overlapping trades e.g. add a new 45DTE position each Friday? I think it might diversify your strikes. Nice work, thanks

hey Dave, are you going to look at higher delta strangles? interested in seeing the 20 delta ones like your IC backtests.

good work, thanks.

Hi Dave! I just wanted to thank you for doing this. Your blog is pure gold! Cant wait for more of these! Also I would like to see some higher deltas, 20 is too hardcore for me, but something like 12?

FrankNYC, thanks for your comment.

The goal of my blog is to compare relative performance of strategies and trades. One nice result of this approach is that it is easy to see differences between strategies and trades...and the applying this generic information to live trading to reduce risk and smooth returns.

Your suggestion to overlap trades is one such approach. In the past, I used to initiate multiple hedged RUT condors for a given expiration....usually four...the first initiated around 60 DTE, and the three subsequent entered at around three day intervals from the first trade...hope that makes sense. I may trade this way again in the future, as it worked as a good risk reduction approach.

Your suggestion to initiate new 45DTE trades each week is a similar approach. Give it a shot, and share your results after a few months of live trades...would be great to hear how it works.

Thanks,

Dave

Thanks for your comment Optionhunt.

I may look at higher delta strangles in a future series, but not this one...I've already completed all of the backtests for this series.

Thanks,

Dave

2HC2Die

Thanks for your comment.

I'll consider higher delta strangles in a future series of posts. BTW, I also want to expand the exits to match more closely with the RUT Iron Condor series.

Thanks again,

Dave

Post a Comment