For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Strangle Series - Higher Loss Thresholds

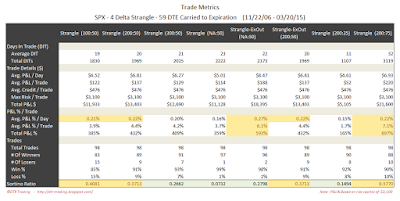

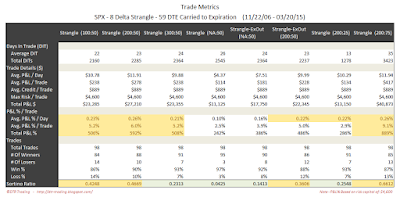

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (Trade Details (%) - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

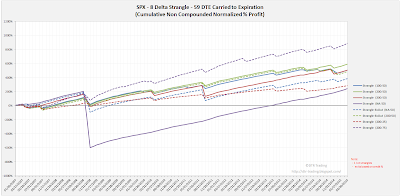

Also note, that all of the blog posts for the SPX strangle series have equity curves with identical y-axis scales.

4 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

6 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

8 Delta Short Strikes

|

| (click to enlarge) |

|

| (click to enlarge) |

With the 59 DTE tests, the highest average P&L per day readings occurred with the 8 delta short strike variations. The 200:75 and 200:50 variations at 8 delta looked particularly good. In the next post we will look at these same deltas and exits, but on the SPX 66 DTE short strangle.

You can follow my blog by email, RSS feed or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

Hi Dave, would you mind explaining what does "4 delta short strangle", or "6 delta" or "8 delta" mean? Lets say today (7/22/2015) the SPX closed at 2114. The 2 months DTE would be Sept 18 expiration. What strikes would "4 delta", "6 delta", and "8 delta" be for these strangles? How many contracts (puts and calls, equal or different numbers?) would be used for each of these trades?

Thanks much, ZE

Zvi,

A short strangle, is constructed by selling a call and a put. The location of the call and put are being determined by delta in my backtests. For example, a 4 delta short strangle is selling a -4 delta put and a +4 delta call. The SPX is currently at 2104. For the Sept expiration, the strike locations are approximately 1810 for the put and 2225 for the call.

The September expiration on the SPX is currently at 56 days-to-expiration (56 DTE). Trade entries were only based on DTE, and did not take into account any other factors.

All of the backtests for the SPX strangle were one-lots. Selling 1 put and 1 call. The P&L numbers are based on PM margin, so for TOS that would mean having an account size of at least $125K in order to qualify to take the test.

Please see the trade setup page (link at the top of this page) for additional info.

Thanks,

Dave

Post a Comment