This post will review the combined trade metrics from both sets of articles for the Iron Condors on the RUT. I've also expanded the range of all of the results through the April 2015 expiration. We will look at how the high loss threshold strategy variations compare to the lower loss threshold strategy variations, as well as the different starting structures. As a bit of review, the first series looked at the following three starting structures for iron condors:

- Standard (STD) - an iron condor with an equal number of put and call credit spreads.

- Delta Neutral (DN) - an iron condor with fewer call credit spreads than put credit spreads in order to create a position delta near 0. This structure performs better in an advancing market.

- Extra Long Put (EL) - a Standard iron condor with one additional long put for every 10 put credit spreads. This structure performs better in a declining market.

- Exit at 8 DTE

- ML40% - exit when the loss is equivalent to 40% of the margin for the position OR 8 DTE

- BSP - exit when the market is below the strike of the short put (BSP) OR 8 DTE

- 0.6:0.6 - exit if the trade has a loss of 60% of its initial credit OR if the trade has a profit of 60% of its initial credit OR 8 DTE

- 0.6:0.9 - exit if the trade has a loss of 60% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- 0.7:0.9 - exit if the trade has a loss of 70% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- 0.8:0.9 - exit if the trade has a loss of 80% of its initial credit OR if the trade has a profit of 90% of its initial credit OR 8 DTE

- STD - NA%:NA% - exit at 8 DTE -- this is the same as item 1 above.

- STD - NA%:50% - exit if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 100%:50% - exit if the trade has a loss of 100% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 200%:50% - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 200%:75% - exit if the trade has a loss of 200% of its initial credit OR if the trade has a profit of 75% of its initial credit OR 8 DTE.

- STD - 300%:50% - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

- STD - 300%:75% - exit if the trade has a loss of 300% of its initial credit OR if the trade has a profit of 75% of its initial credit OR 8 DTE.

- STD - 400%:50% - exit if the trade has a loss of 400% of its initial credit OR if the trade has a profit of 50% of its initial credit OR 8 DTE.

The first table, shows the average normalized P&L per day by delta, DTE, and strategy. It's easy to see that the highest daily returns are concentrated in the STD starting structure with 20 delta shorts, and a starting DTE in the 59 to 66 range. Also, the shorter DTE (38 - 45) with the higher loss thresholds were another area of high daily returns.

|

| (click to enlarge) |

The second table shows the average P&L per trade by delta, DTE, and strategy. It's clear from this table that the highest overall returns were concentrated in the 16 and 20 delta variations at 59 to 80 DTE. The 12 delta short strike variations also exhibited this same DTE trend. Additionally, as a group, the 20 delta, 66 DTE variations with lower risk:reward exits had the highest returns.

|

| (click to enlarge) |

The third table, below, shows the win percent / win rate by delta, DTE, and strategy. The highest win rates are concentrated with the 8 delta short strike strategy variations, and also in the STD high loss strategy variations (across deltas). Basically, the greater your tolerance for unrealized losses, the higher your win rate...this was evident by the variations that were the darkest green in the table below. Another interesting point is that at 8 delta, the DTE did not have a big impact on the win rate if your risk tolerance was high.

|

| (click to enlarge) |

In the fourth table, we see the Sortino Ratio by delta, DTE, and strategy. The highest Sortino's were present with the 59 to 66 DTE variations with the low risk:reward exits...this trend was persistent across starting structure and short strike deltas...but strongest at 8 delta.

|

| (click to enlarge) |

The fifth table shows the profit factor metric by delta, DTE and strategy. The highest profit factors were present in the 59 to 66 DTE strategy variations, as evident by the presence of the dark green cells below. In addition, the 8 delta short strike strategy variations have the highest profit factor numbers. At 8 delta, the 38 and 45 DTE variations also were an area of profit factor strength.

|

| (click to enlarge) |

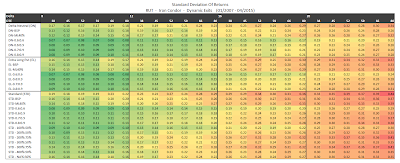

Lastly, table six displays the standard deviations of returns by delta, DTE, and strategy. In this table, the lower the SD number, the darker green the cell in the table. The lowest standard deviations of returns were concentrated with the 8 delta strategy variations. The low risk:reward variations were the strongest at 8 delta, and this strength extended into the other short strike deltas.

|

| (click to enlarge) |

So when should you exit your Iron Condor? As usual, it depends on what metric is most important to you.

Highest Return Per Day / Per Trade - I would concentrate on the STD structure, 59 to 66 DTE, 20 delta short strike variations with a low risk:reward exit: STD-0.6:0.9, STD-0.7:0.9, STD-0.8:0.9.

Highest Win Rate - I would look at the 8 delta short strike variations, and a trade imitation at 59 to 80 DTE. My preference here, would be for one of the following exit variations: STD-200%:50%, STD-200%-75%, STD-300%-50%, or STD-300%-75%. There are other variations that work as well, but these are my favorites in this category.

Sortino Ratio - I wouldn't select a trade solely on the Sortino Ratio. I would look for the intersection of Sortino and returns, for example. In this case, the same variations that were selected in the highest return per day / per trade category also have decent Sortino numbers.

Profit Factor - I would use the same approach for Profit Factor as I used for Sortino Ratio. I would look for the intersection of high Profit Factor numbers and some other criteria (for example daily returns).

Standard Deviation of Returns - Any of the starting structures and DTE at 8 delta have low standard deviations of returns...as long as a risk reward exit is used. Take your pick here...but I would gravitate towards the STD low risk:reward variations.

There are really two main trade approaches that jump out at me when reviewing these results:

1) You can either use high delta short strikes (20 delta) in the 59 to 66 DTE range - exited early (60% to 80%) when there is a loss

OR

2) You can use lower delta short strikes (8 delta) in the 59 to 66 DTE range - and allow your unrealized (and possibly realized!) losses to get fairly large (200% to 300%) during the life of the trade.

Either of these general approaches will work.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

13 comments:

that 0.6:0.6 exit is a good addition for the backtest

good job :)

is your entry date randomized or fixed at certain date?

because i notice weird results with 52dte

thanks

Hi Albert,

Thanks for your comment.

The entry dates are all selected based on specific days to expiration (DTE). In my backtests, I have primarily concentrated on entries at 38, 52, 66, and 80 days prior to each expiration as entry days.

In this most recent set of tests on the RUT, I expanded the entry days to 38, 45, 52, 59, 66, and 80.

I'm not sure what you mean by "weird results with 52DTE". Can you elaborate?

Thanks,

Dave

hi Dave,

yes i notice a lot of new variables on the tests

it gives a better understanding of best entry/exit strategy

about 52DTE, in P&L/day table, it has less profits than 45 and 59 DTE

i expect a bit more similiar results or in-between value of 45-59 DTE

just trivial thought, sorry

----

i like your first trade approach

(20 delta) in the 59 to 66 DTE range - exited early (60% to 80%)

i'm using the setup on IWM

btw, as you know we are in a bull market (neutral to bullish RUT)

what do you think of using IC in bear market?

is the premium high and safety enough for options seller?

thanks :)

hey Dave, great post. Was wondering if you guys have looked into higher delta strangles/ICs or even ATM straddles/Iron Flies. There's a clear trend that higher delta results in higher net P/L. It also makes mathematical sense since you are extracting more theta each day. So i was wondering why you guys didn't look into 25 30 35 40 delta etc.

One more question about your backtesting parameter. when you say X DTE, do you always close the trade before you put on the next one or will you have multiple trades on at the same time with different days to expiration. since RUT have weekly expirations you can conceivable have a trade on for each week, with 66 days to 8 DTE that's 58 days, so you can have 58/7 or 8 stacks on 10 spreads on at the sametime.

Lastly, to what degree would you say curve fitting/data fitting starts playing a major role? For instance, STD exits 0.7/0.9 to 0.6/0.6 are all within .3% of each other in returns. At what point do you start thinking that overfitting is starting to make the results of these different exit points negligible.

Hi Albert,

Thank you for the note.

Your question about the 52 DTE trades not being consistent with the DTE pattern of returns is a good one. I went back through the raw data, and can confirm that the data is correct.

It turns out that the 52 DTE trades just happened to start at the wrong time in terms of credit received, theta, etc. For example, the 52 DTE STD 16 delta 100:50 trade had a few more losers than the corresponding 45 DTE version. Also the total losses as a percent of total wins was 57% for the 45 DTE version, but 67% for the 52 DTE version. This is a good example of how timing your trade initiation has an impact on returns.

Your question regarding bear market performance is also good. The back test period used for all of my testing includes the big market drop of 2007-2009, so the performance during a bear market is included in my results. Personally, I will keep my size small and use defined risk trades once our uptrend breaks and I have a couple of losing months.

Thanks,

Dave

Hi Michael,

Good questions.

I have looked at straddles and iron flies, and have posted some of the associated equity curves on my Twitter feed. From my testing, I have found that these need to be actively manged to be profitable. IC's on the other hand do not need to be actively managed in order to be profitable...simple entry and exit rules are all you need.

Much of my backtesting is focused on testing variations/simplifications of strategies that I currently trade or have traded, which is why I have focused primarily on the lower delta ICs and strangles.

Regarding your DTE question, there can be overlapping trades / multiple trades on at one time during the backtests. The backtests use only the monthly expiration options...I am not using the weeklies.

The exits were picked randomly, no curve fitting was performed. Running the tests and analyzing the data is time consuming, so I tend to gravitate toward exit parameters that are close to those that I would personally be comfortable trading.

Thanks for your questions.

Dave

Excellent information, Dave. Just a few questions, though, if you have a moment. Do your trade parameters always have you entering with 10 calls/puts in a STD structure? Even when your capital grows significantly? Is there a parameter for determining what the right "starting" quantity would be based on different account sizes? What does it mean that a trade loses 50% in a month? Does that mean the account size was halved? I imagine this would depend on leverage so that an account that's more leveraged than the one you test may be wiped out rather than have its account size halved.

Thanks so much.

Thanks for the comment dave.

The backtests all use a fixed contract size, except for the delta neutral structures. Sometimes I use 1 contract and sometimes 10, and I try to note in the particular blog post if there is a change during a series. Otherwise, the first post in any given series describes the strategy setup.

In my first blog post on backtesting I described my approach. The goal with my blog is to compare relative performance of strategies and individual trades. I am not trying to simulate the growth of an account.

Re the 50% question, I'm not sure if you're referring to the dynamic exits or the loss shown in an equity curve. From an exit perspective, I typically note whether an exit is based on margin or credit received. If you are looking at the equity curves and drawing a conclusion based on a drop, you'll need to confirm whether the drop occurred over one or more months. These losses are based on the percentage of margin required for a trade. For example, if the margin for a trade is $20k, a 50% margin loss is $10k. If there are three in a row, then it would look like a loss of $30k.

Most traders do not use all of their account size to meet their margin requirement. I typically only put on positions up to the point that I have used 50% to 60% of my account size to meet margin requirement. I am currently at 27% with five positions.

Hope this answers your questions.

Thanks,

Dave

Dave, this blog has been a great resource. I thank you for putting this information out. One question, regarding margin when you say

" I have used 50% to 60% of my account size to meet margin requirement"

Is that because you are using Portfolio margin in your account and not Reg-T?

Thank you for the feedback lyad.

Yes, this is my PM requirement. Regardless of the account type (PM or Reg-T), you wouldn't have a single position sized to the level that your max loss on that position would wipe out your account.

The size of each position is up to the trader, But you need to consider your max loss levels (e.g 200% of credit received), versus the number of positions, versus your account size. If you have five positions, how big of an account hit would you take if all five took 200% losses...would your account survive.

Hope this helps,

Dave

Hi Dave, not sure if you saw this but it is interesting. CBOE has a few common Option strategies that people can look at as Benchmark Indices.

http://www.elitetrader.com/et/index.php?threads/new-cboe-benchmark-indicies.293277/

Hello,

I am very impressed by the quality and transparency of your work. I actually built a data base and conduct by hand a back testing, primarily focusing on weekly options.

I have a question: in case your stop loss is hit, how do you exit, end of day, at the 15 minutes print that first hit the stop loss level, exactly at the stop loss threshold, with the risk that there was an opening gap further away ?

For the profit target, this is easier, because the limit price for the IC can be entered as a limit order.

Gabriel

I am using end of day (EOD) data from iVolatility (more details can be found on my FAQ page). Entries and exits are all based on EOD prices, which can be either better or worse than the intraday prices we actually trade on...and these differences do not impact the results when I've compared performance using 15 min data.

Thanks,

Dave

Post a Comment