For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Straddle Series - P&L Exits.

No IV Rank Filter

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility rank (IVR) of the SPX on the date of entry. Entering these trades at 45 DTE and utilizing our loss exits and 35% credit exits (described here), resulted in the equity curves below.

|

| (click to enlarge) |

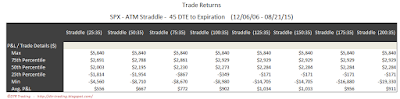

The trade metrics for these different exits are shown in the table below. The (125:35) and (150:35) variations stand out with solid P&L % / day readings, highest total P&L %, and the highest win rates.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

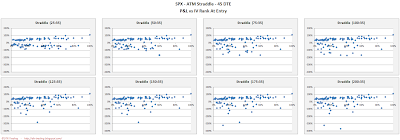

Below are three sets of scatter plots for selling 45 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IVR for the SPX. The IVR was captured on the day each trade was initiated. As we noticed in the prior articles, there is a clear trend of increasing P&L with increasing IVR.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated. Higher IV resulted in higher returns, but the majority of the profitable and unprofitable trades occurred at lower IV...below 35...the same pattern we noticed in the last post on managing profits at 25%. We also see loss clustering between 10 and 20 IV at the higher loss management levels. We noticed this pattern in the last post as well.

|

| (click to enlarge) |

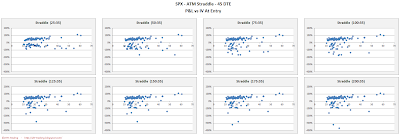

The third image shows P&L in percentage terms versus days-in-trade (DIT). We see the same two patterns that we observed in the prior articles...when managing losses early (25%, 50%), the losses were fairly evenly distributed across DIT. As the loss management becomes less aggressive (125% and higher), we see that the losses are concentrated later in the trades. Also, as we've seen in the other posts, most of these losses were not realized until expiration...meaning many of these particular losses were less than our loss threshold values.

|

| (click to enlarge) |

IV Rank > 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is greater than 50% ( >50% ). Entering these trades at 45 DTE and utilizing our loss exits and 35% credit exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. As we've seen with the earlier articles, there are significantly fewer trades that meet the >50% IVR criteria. The best variations of the group have much higher P&L% per day readings. We observed this pattern with the 10% and 25% profit management levels also. The win rate is 86% for the top four variations, which all have higher loss management thresholds.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

IV Rank < 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is less than 50% ( <50% ). Entering these trades at 45 DTE and utilizing our loss exits and 35% credit exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. Using the lower IVR filter did not improve any of the metrics.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

In the next post we will look at the backtest results of 45 DTE ATM SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 45% of the credit received.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

2 comments:

awesome!! using iv rank now your blog is amazing thank you

Thank you...I appreciate your feedback!

Post a Comment